This article was originally published on Fool.com. All figures quoted in US dollars unless otherwise stated.

Trading around $3,200, Amazon's (NASDAQ: AMZN) stock comes with a hefty price tag. Amazon shares are on an incredible rally, even if you zoom out and look at it from a longer-term perspective.

Why are its shares so expensive? Let's dig a little deeper and try to answer that question. You may find the conclusion a bit surprising.

What's causing the surge in Amazon's stock price?

Since the start of the pandemic, more and more people have been relying on Amazon to deliver what they want and need to their doorstep. In the first three quarters of the year, sales are up by 34.9% from the same period in 2019. Furthermore, the company is guiding investors that its fourth-quarter revenue is likely to increase by about 33%. And since coronavirus cases are surging in many regions of the world, it would not be surprising if Amazon reports much higher results than expected.

Amazon last commented on Prime membership totals in January, when it had 150 million members. Revenue from subscription services, which includes membership fees paid by Prime members, has increased by 53% in each of the last two quarters. So in the company's next update, Prime membership is likely to be much higher. Prime members tend to shop more often and spend more than non-members do, and their presence attracts third-party sellers to Amazon's platform.

Finally, the Amazon Web Services cloud computing business continues to grow revenue rapidly. This is especially important because in the third quarter, even though AWS made up 12% of total revenue, it provided 57% of overall operating profits. High double-digit growth in such a profitable segment brings in cash flow that it can then direct into operations, making it an even more desirable destination for online shoppers.

Overall, Amazon continues to give shareholders a lot to be happy about.

Is Amazon's stock actually expensive?

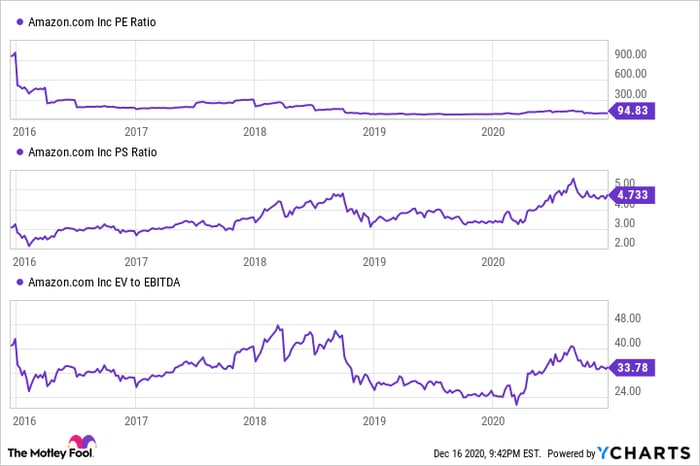

You might be thinking, "Of course it's expensive -- it costs $3,200 per share!" And when looking at it from that perspective, you would be absolutely correct. However, if you consider Amazon on several key financial metrics (see chart below), you will find that it's not as expensive as you may have initially thought. Its price ratios on three important financial metrics are below historical levels. In particular, its price-to-sales ratio isn't too much higher than the S&P 500's average around 2.7, and it's right in line with the tech-heavy Nasdaq Composite Index, currently around 4.3.

What's more, Amazon is a better company today than it was when it was trading at higher multiples. The coronavirus pandemic has attracted many people and businesses to Amazon's products and services. Some of those customers are likely to remain even after the eventual return to normalcy.

Data source: YCharts. PE = price-to-earnings, PS = price-to-sales, EV = enterprise value, EBITDA = earnings before interest, taxes, depreciation, and amortization

It may still be daunting to think of paying $3,200 to buy one share of stock. You may be comforted in knowing that many brokerages now offer the ability to buy fractional shares. That puts Amazon's stock within the budget of all those interested in becoming shareholders -- whether you have $32 to invest or $3,200.

This article was originally published on Fool.com. All figures quoted in US dollars unless otherwise stated.