Altium Limited (ASX: ALU) shares have edged 5.41% higher this year, but is the Aussie tech company in the buy zone?

What's happened to Altium shares in 2020?

The Aussie tech share started the year in typically strong fashion. In fact, Altium hit a new 52-week high of $42.76 as recently as February 17. There's been quite a bit of downhill from there with Altium shares bottoming at a 52-week low of $23.11 on March 23.

Unsurprisingly, Altium was not the only WAAAX share to fall lower in March. Even Afterpay Ltd (ASX: APT) shares fell to $8.90 but have since bounced back to over $46 per share.

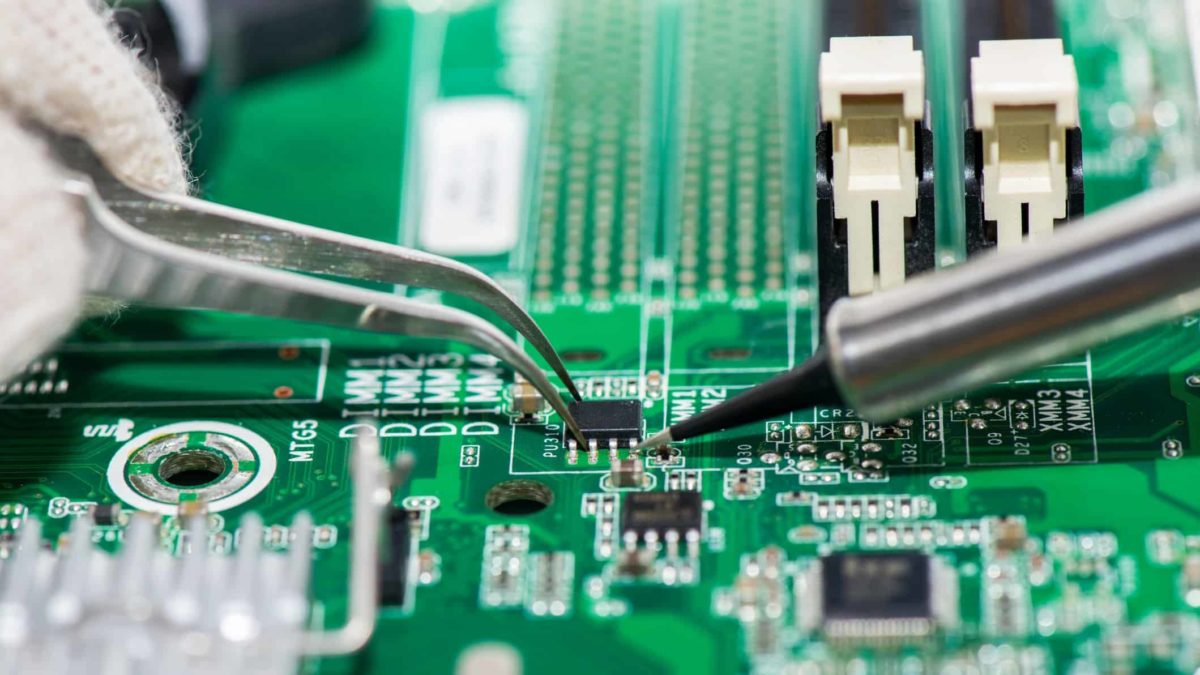

The Aussie-American software business focuses on electronic design systems for 3D printed circuit boards (PCBs). However, many of the company's small and medium enterprise (SME) business customers have been short on cash amid the pandemic.

Altium shares have made a recovery since their March lows, and are trading at $36.60 per share right now. That's despite the recent business update announcing some headwinds for the tech group.

Altium has launched 'attractive pricing' and extended payment terms to drive volume. This means that while volume should increase, the price component is likely to drive down revenue and cash flow in the short-term.

However, it's not all doom and gloom for the software company. Altium's push for more volume could drive market share and position it as a clear market leader in the medium to long-term.

With a strong cash balance and clear strategic goals, Altium shares could be on the move again in 2020.

There's also something to be said for a strong US presence. The nature of the pandemic has forced many countries to look internally for business growth.

Altium could be well-placed to drive further change in both Australia and the United States thanks to its unique market positioning.

Foolish takeaway

No one knows where Altium shares are headed in 2020, but I feel the company's long-term outlook still looks good. I think it could be a good value ASX tech share to buy if you want to boost your portfolio growth potential.