This article was originally published on Fool.com. All figures quoted in US dollars unless otherwise stated.

Video-streaming veteran Netflix (NASDAQ: NFLX) is trading near all-time highs right now, currently fetching $440 per share. Jefferies analyst Alex Giaimo sees more gains ahead. Giaimo opened coverage of Netflix on Thursday with a buy rating and a price target of $520 per share.

The investment thesis

The analyst cited three main reasons to own Netflix shares today:

- This company's addressable market is "vastly underappreciated."

- Improving profit margins will lead to sustainable free cash flows over time.

- Netflix has proven its "ability to create value" in a rapidly changing market.

Giaimo expects year-over-year subscriber growth to remain in double-digit percentages until 2023 alongside a relatively stable penetration of the domestic market. His model assumes Netflix will widen its international household penetration from 18% to 28%, addressing a global market of roughly 850 million broadband households. Meeting the analyst firm's targets would give Netflix approximately 285 million subscribers in 2023, up from 183 million paid memberships today.

The financial background

Netflix has been consuming a lot of cash in recent years due to the high up-front costs of producing a lot of original content. Management has said that 2019 should be the peak of Netflix's cash burn, topping out at $3.1 billion. Since content production efforts have ground to a halt under COVID-19 lockdown policies, Netflix expects to consume roughly $1 billion of free cash in 2020, followed by larger content production expenses in 2021.

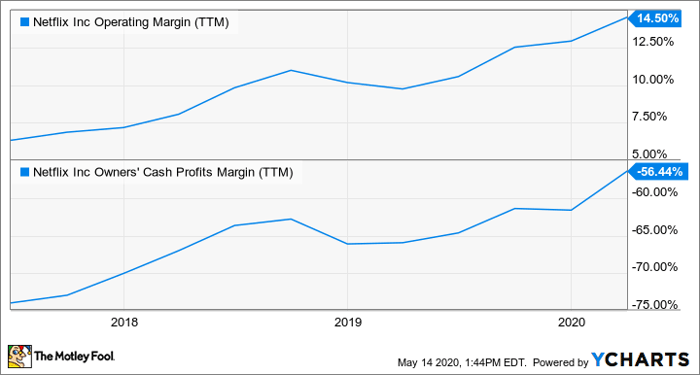

The key to unlocking positive cash flows is indeed found in wider profit margins. Here's how Netflix's operating margins and cash profit margins have developed over the last three years:

NFLX Operating Margin (TTM) data by YCharts

This article was originally published on Fool.com. All figures quoted in US dollars unless otherwise stated.