The Australian Prudential Regulation Authority (APRA) has made waves in recent weeks by releasing a new platform for assessing the long-term performance of all major Australian superannuation funds. As super is compulsory for most workers, this should be good news for anyone keen to check that their nest egg is growing at the healthiest rate possible.

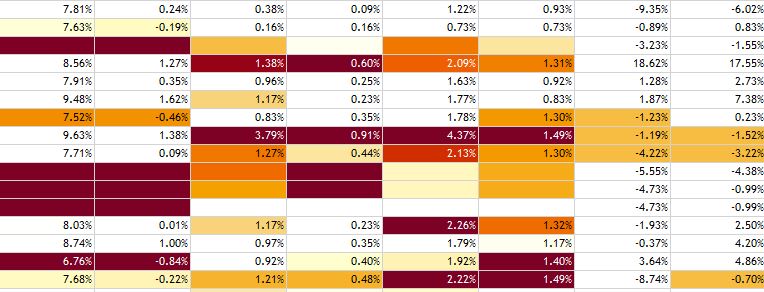

This new APRA platform (which you can view with this link) is structured as a 'heatmap' – with colour coded performance indicators across the metrics that are key to establishing whether your money is working as hard as it can for your retirement. These include fees across different balance sizes, investment returns and allocation to growth assets.

Helpfully, funds that raise flags across any of these metrics are given a coloured cell – with said colour darkening on statistics that show the fund is severely under-delivering. It's worth noting that only MySuper products are evaluated here, so if you don't have a MySuper fund, you'll have to do some independent digging.

Here's a sneak peek at how this looks (you'll have to check it out yourself to find your own fund).

Source: APRA

What to look for

There are 2 major factors that govern how much money your super fund will return to you at the end of your working life – fees and investment returns. Investment returns reflect how fast your money is compounding and growing, whilst fees (even if they seem small) drain both present value and future returns.

You will also want to pay attention to the 'growth allocation' section. If you're a conservative/capital conscious investor (maybe approaching retirement), you might be glad to see your 'conservative' super fund has outperformed its peers. But if this is because it has a growth allocation of 60%, it might be a cause for concern (its not too hard to outperform bonds at the moment, after all).

Foolish takeaway

I encourage taking this opportunity to do a check-up of your super. It's your hard-earned, taxed money at the end of the day, despite it being out of reach until the golden years. Even if you don't use the heatmap, a quick check on your super fund's fees and performance is always worth it in my view.