The Paradigm Biopharmaceuticals Ltd (ASX: PAR) share price was on form again on Thursday.

The biopharmaceutical company's shares pushed 4% higher to $2.93 on the day of its annual general meeting.

This latest gain means the Paradigm share price is now up 196% from 99 cents at the start of the year.

Why did the Paradigm share price push higher today?

This morning Paradigm released its annual general meeting presentation which reminded investors of the massive market opportunity its ZILOSUL drug has.

ZILOSUL is the brand name of its repurposing of Pentosan Polysulfate Sodium (PPS). This is an FDA-approved drug that has been used safely for treating inflammation for over sixty years.

Paradigm is focusing on repurposing PPS to treat osteoarthritis (OA). This is a market with over 31 million sufferers in the United States alone.

Things look very promising for ZILOSUL. Its Phase 2b trial in OA successfully met primary, secondary, and exploratory endpoints.

The company is now planning to file an Investigational New Drug Application (IND) with the FDA for a phase 3 clinical trial in early 2020. Which means there is the potential for a trial readout and regulatory submission in the United States as early as 2021.

Will it be worth the wait?

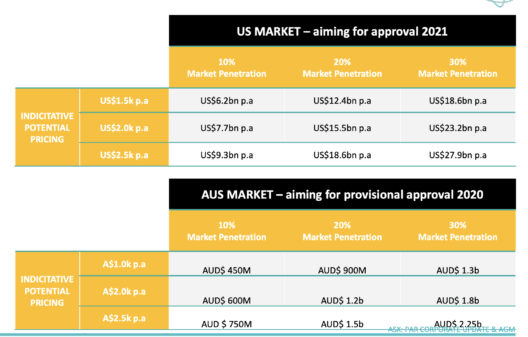

As you can see on the chart below, the company estimates that ZILOSUL has the potential to generate significant revenues.

Should you invest?

At the last count, Paradigm had 193,156,511 shares on issue. This means that it has a market capitalisation of approximately $570 million today.

Clearly if it can win even a 10% share of the U.S. market, its shares would be worth many multiples more than they are today.

This could make it worth considering if you're a patient and long-term focused investor. Especially given its cash balance of ~$75 million. These funds should comfortably see Paradigm through to a commercial launch, if it gets that far.

However, I would suggest you limit an investment to just a small part of your portfolio. After all, there's still a lot of work to do before that is even a possibility.

In addition to Paradigm, I think Clinuvel Pharmaceuticals Limited (ASX: CUV) and Medical Developments International Ltd (ASX: MVP) are worth watching closely as well.