The Westpac Banking Corp (ASX: WBC) share price won't be going anywhere today after the banking giant released its full year results and then requested a trading halt.

Why are Westpac shares in a trading halt?

Westpac requested the trading halt whilst it undertakes the largest capital raising of the year.

According to the release, Westpac is seeking to raise approximately $2.5 billion in capital. This will increase its CET1 capital ratio by ~58 bps on a pro-forma basis to ~11.3%.

It will also give the bank the flexibility to respond to changes in capital rules and for potential litigation or regulatory action.

How did Westpac perform in FY 2019?

I think it is fair to say that Westpac has just completed an extremely difficult 12 months. During the period the bank reported a 16% decline in statutory net profit to $6,784 million and a 15% decline in cash earnings to $6,849 million.

The bank's net interest margin tumbled 10 basis points to 2.12% and its return on equity fell 225 basis points to 10.75%.

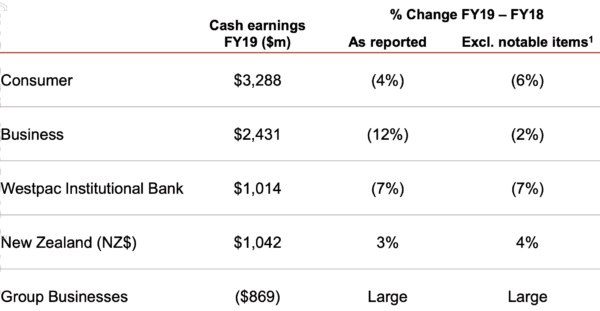

Here's a breakdown of how its segments performed:

Westpac Group CEO, Brian Hartzer, said: "Our result was impacted by customer remediation costs and the reset of our Wealth business. Excluding these notable items2, cash earnings were down 4% on FY18, which was mainly due to a reduction in wealth and insurance income from the exit of our financial planning business, higher insurance claims, and the impact of regulatory changes on revenue."

This underperformance left the bank with a CET1 ratio of 10.7%. Which is marginally higher than APRA's unquestionably strong benchmark.

In light of this poor performance, the bank elected to cut its final dividend down by 15% to 80 cents per share. But unlike rival Australia and New Zealand Banking Group (ASX: ANZ), this dividend remains fully franked.

Mr Hartzer explained: "The decision to reduce our second half dividend to 80 cents per share was not easy, as we know many of our shareholders rely on our dividends for income. However, we felt it was necessary to bring the dividend payout ratio to a more sustainable medium-term range given the capital raising and lower return on equity."

Outlook.

Mr Hartzer expects 2020 to be equally challenging. He advised that the bank expects Australian GDP growth to be below trend and notes that consumers continue to remain cautious with their spending.

He added: "We expect system credit growth in the year to September 2020 to lift from 2.7% this year to 3%. That will be largely driven by housing where we expect a lift from 3.1% to 3.5%, although business credit growth is expected to slow somewhat from 3.3% to 3%. Progress in dealing with trade disputes, particularly between the US and China, will be important for the outlook for the global economy and the flow on effect on business confidence and investment plans in Australia."

"Although 2020 will continue to be challenging, we believe our service led strategy, disciplined growth and solid portfolio of businesses will deliver for shareholders and customers," he concluded.