The Australia and New Zealand Banking Group (ASX: ANZ) share price will be on watch today following the release of its full year results.

How did ANZ perform in FY 2019?

During the 12 months ended September 30, the banking giant reported a statutory profit after tax of $5.95 billion. This was a decline of 7% on the prior corresponding period.

ANZ's cash profit from its continuing operations was $6.47 billion, which was flat on the prior comparable period. Cash earnings per share increased 2% to 228 cents.

The bank's cash profit from continuing operations appears to have fallen a touch short of expectations. According to a note out of Goldman Sachs, its analysts were expecting an increase of 0.9% to $6,545 million.

A final dividend of 80 cents per share has been declared. However, this will only be partially franked at 70%.

Other key takeaways.

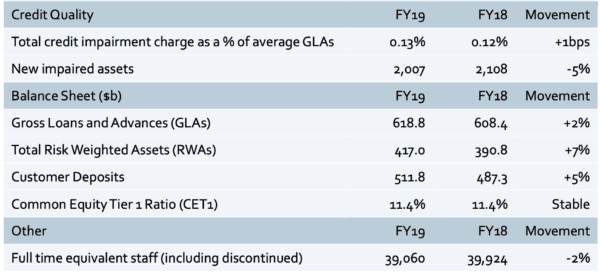

ANZ's capital position remains very strong. It finished the period with a Common Equity Tier 1 Capital Ratio stable at 11.4%. This is around $3.5 billion higher than APRA's unquestionably strong measure.

Total credit impairment charges as a percentage of Gross Loans and Advances increased 1 basis point to 0.13%. New impaired assets fell 5% on the same period last year.

Other key metrics are on the table below:

Challenging trading conditions.

ANZ's chief executive officer, Shayne Elliott, appeared pleased with the bank's performance in the face of challenging trading conditions.

He said: "This has been a challenging year of slow economic growth, increased competition, regulatory change and global uncertainty. Despite the challenges, we maintained focus on improving customer experience, balance sheet strength and improving our culture and capability. In doing this, we significantly reduced the cost and risk of operating the bank even though strong headwinds impacted the sector. Investment was at record levels and we are a far stronger bank as a result of the progress made this year."

Looking ahead, Mr Elliott expects these challenging trading conditions to persist.

He added: "The Australian housing market is slowly recovering, however we expect challenging trading conditions to continue for the foreseeable future. We expect the operational improvements made to our Australian home loans business to help restore market share in our targeted segments. Record low interest rates and intense competition will continue to impact profitability."

The US and China trade war is also having an impact on the bank.

"Geopolitical tensions will also place pressure on earnings given our exposure to global trade, although this can be managed through the diversification of our business. Increased compliance and remediation costs will also need to be closely managed over the foreseeable future," added the chief executive.

Despite this, the CEO appears cautiously optimistic and prepared for anything thrown at the bank in 2020.

"Capital efficiency will remain a focus, particularly as we manage the proposed changes impacting our business in New Zealand. While these changes are not final, we are starting from a strong capital position with solid organic generation capability. The environment has evolved as predicted. We have prepared well and our strong sense of purpose has us positioned to thrive in what will continue to be a tough period," concluded Mr Elliott.