The Westpac Banking Corp (ASX: WBC) share price is trading lower this afternoon following an update on its upcoming second half results.

At the time of writing the banking giant's shares are down 0.6% to $28.80.

What did Westpac announce?

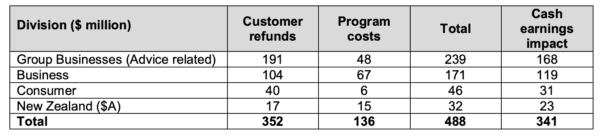

This afternoon the bank revealed that its second half cash earnings will be reduced by an estimated $341 million due to its customer remediation programs.

According to the release, the majority of the $341 million relates to customer payments (including interest) identified in prior periods, with the balance relating to costs associated with running its remediation programs.

The release explains that this includes provisions associated with financial advice. It advises that "the majority of new provisions are related to ongoing advice service fees and changes in how the time value of money is calculated including extending the forecast timing over which payments are likely to be made."

Westpac's current estimated provision associated with authorised representatives now represents 32% of the ongoing advice service fees collected over the period. Whereas, for salaried planners the estimated percentage is 26%.

Also included in the $341 million are provisions associated with interest only loans that did not automatically switch to principal and interest loans when required.

A summary of its notable items can be seen on the table below:

Westpac CEO, Brian Hartzer, commented: "A key priority in 2019 has been to deal with outstanding remediation issues and refund customers as quickly as possible. The additional provisions announced today are part of that commitment."

"As part of our 'get it right put it right' initiative we are determined to fix these issues and stop these errors occurring. We will continue to review our products and services to ensure they deliver the right outcomes for customers, and if necessary, make further provisions," he added.

The banks intends to release further details on these notable items with its FY 2019 results announcement.