One of the newest listed investment companies (LICs) on the market, WAM Global Ltd (ASX: WGB) has had an interesting start to its life. WAM Global is the first Wilson Asset Management LIC to have a mandate to invest beyond our shores, which is a bold new move for a company that made its fortunes on the high-yielding Australian market.

But I think WAM Global could grow to be a massive dividend stock over the next few years – even eventually rivalling its older siblings WAM Capital Ltd (ASX: WAM) and WAM Research Ltd (ASX: WAX) for market-dominating dividend yields.

What does WAM Global do?

WAM Global focuses on "undervalued international growth companies and exposure to market mispricing opportunities" across global markets. Since launching in June last year for $2.20 a share, the WGB share price has trended lower, currently trading for $2.10 at the time of writing. This is despite the LIC having a net tangible asset (NTA) value per share of $2.40 and delivering a return of 9.3% p.a. since its launch.

Currently, WAM Global is primarily invested in US companies (at 60.8% of its portfolio), with Europe and the UK making up a further 16% and Japan and 'others' rounding out the rest. Some of its top holdings include American Express Co., Waste Management and aeroplane manufacturer Airbus.

What about dividends?

WAM Global has only recently announced the company's first dividend payment of 2 cents per share (which incidentally will be paid this Friday). Despite the fact that this yield is only sitting at 0.95% based off of this first dividend (or 1.9% annualised), it is still only early days for this company and management has explicitly stated its goal of growing the payout over time.

As of last month, WAM Global had a profit reserve of 17.7 cents per share in the tank (15.7 cents after Friday's dividend is paid), meaning the company could have paid out more if it so wished.

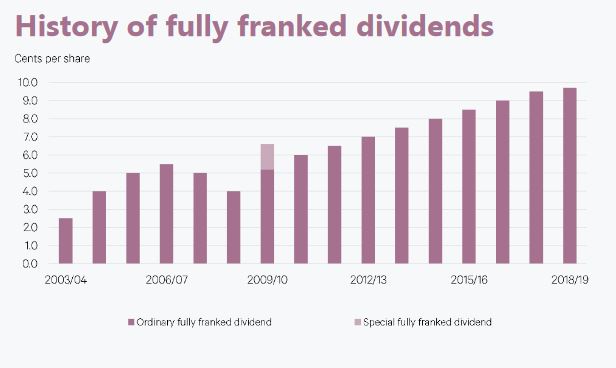

If you look at the dividend history of WAM Research below, you can see how its dividends have performed since inception.

Source: Wilson Asset Management

Foolish takeaway

This is the future of WAM Global, as I see it. I think this company has the potential and ability to deliver exceptional returns for its shareholders over the coming decade, and as a shareholder myself, I look forward to the growing stream of dividends coming in every year from now on.