Through the course of your investing journey, you may have come across the phrase 'currency hedged', or maybe just 'hedged'.

Although it's not something your traditional ASX 'blue-chip' investor would have to worry about, international shares and ETFs are becoming more popular with investors these days – and therefore currency hedging is too.

So, is it something you should worry about?

What is currency hedging?

Put simply – currency hedging means taking exchange rate risk out of the equation. Exchange rate risk is the potential for an investment not priced in Australian dollars to lose value due to currency fluctuations.

For example, say if you bought five shares of Apple Inc. from your broker for US$200 each (not Apple's current share price, but bear with me) at an exchange rate of $1/US $0.75. You've just spent US$1,000 or $1,250 in Aussie dollars. Then say the greenback and Aussie dollar reach parity three months later, but Apple shares stay at $200. You've just lost $250 Aussie dollars from the value of your shares, even though they're worth the same in US dollars.

If this investment was hedged, the currency movements would not affect the value of your shares, meaning you would only see a return if Apple shares appreciated in value. Although this sounds fantastic, bear in mind that it works the other way too.

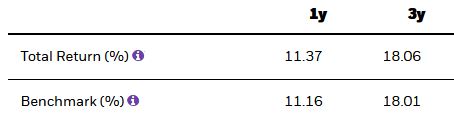

Just take a look at the returns from this iShares S&P 500 ETF (ASX: IVV) – a simple exchange traded fund tracking the 500 biggest companies in the US. Its top three holdings are Microsoft, Apple and Amazon.com

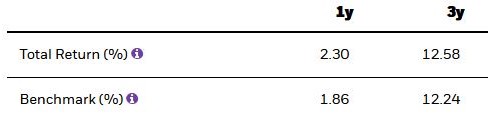

Compare these to the return of the iShares S&P 500 (AUD Hedged) ETF (ASX: IHVV) below – exactly the same underlying companies, but with the exchange rate risk taken out.

Here you can see the effects of the falling Aussie dollar over the last three years.

Should you currency hedge?

I tend to think that currency hedging is unnecessary between major currencies. Although the returns above show hedging in a negative light, eventually the trend will reverse and balance out over the long run. Choosing a hedged investment is often more expensive too; for example, IVV's management fee is 0.04%, but the hedged IHVV fund charges 0.10%

But, if you want more certainty from your investing, by all means go with a hedged fund. It's a personal choice at the end of the day.