Overnight the man in charge of setting up Facebook Inc's (FB) digital currency, Libra, pretty much confirmed to CNBC business television that the project has one key service goal for now.

During an interview David Marcus batted back worries about the high-profile departure of some original partners including Visa, PayPal, and other tech giants to boast the project would succeed anyway.

The project's big problem remains regulatory resistance in particular from legislators determined to protect central bank control of the money supply, with two U.S. senators even writing to the CEOs of some of the Libra Association's original members (Visa, MasterCard, Stripe) to threaten with them regulatory beatings if they take part in the project.

The reason governments and their central bank supporters want Libra browbeaten is concern that it could end up printing or creating money in the way central banks do via the principle of fractional reserve banking.

However, Mr Marcus guaranteed during the interview that Libra will never create money.

Instead the tech guru repeatedly made clear Libra would principally be used as an exchange mechanism to eliminate overseas transfer and bank fees for users wanting to send money around the world. Or for those users simply overseas on holiday.

For example any blue-collar worker wanting to repatriate money overseas to their family would be able to avoid bank fees and the spread charged on the FX rate if the sender and receiver both had a free Libra wallet via Facebook accounts.

Or a holiday maker and Facebook user could buy Libra in Australian dollars before spending it in Thai baht in Thailand with minimal Libra transaction fees.

This is notable as it's analogous to how the internet eliminated the cost of making phone calls overseas.

If you went overseas before 2000 you'd have been ripped off if you wanted to speak to your family back home, but the internet has changed that.

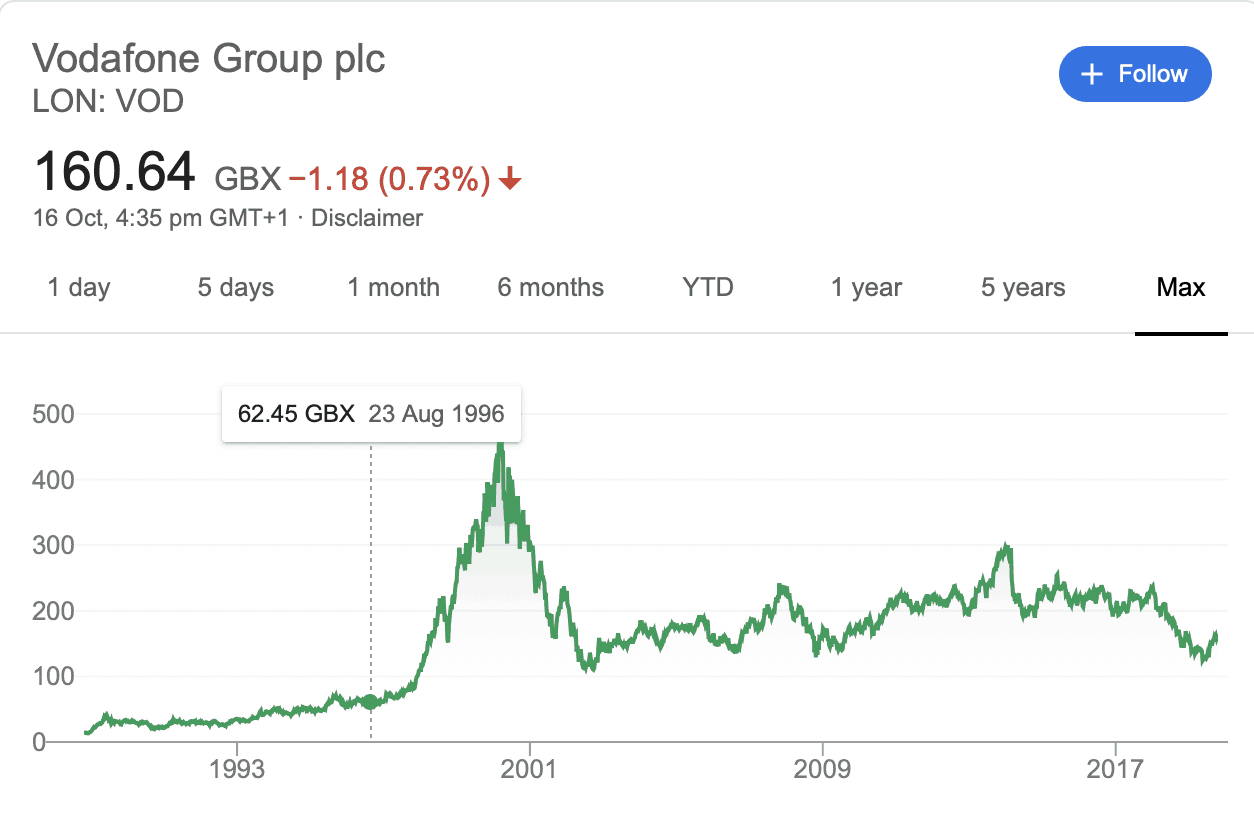

At the same time it has smashed the profits of large global telcos like Sprint or Vodafone. If you don't believe me take a look at their share price charts. They've both gone nowhere since 2000.

Source: Google Finance, Oct 17, 2019.

One conclusion is that the banks are heavily lobbying regulators and the politicians in their pockets to obstruct Libra as it could eliminate an easy source of profits for them. Just as the internet eliminated some of the mobile operators' profits.

Libra isn't beyond reproach though as when Mr Marcus was asked how much in terms of fees Libra intended to charge on transactions I believe he said in the region of 25 basis points for "banked" users. Hardly a revolution.

While emerging market users without bank accounts would be slugged a lot more in fees to receive cash from digital Libra wallets via over-the-counter merchants.

Sill investors in the likes of Commonwealth Bank of Australia (ASX: CBA), National Australia Bank Ltd (ASX: NAB), Westpac Banking Corp (ASX: WBC) and Australia & New Zealand Banking Group (ASX: ANZ) might want to keep in mind the disruptive growth of the digital economy has a long way to run yet.