Is the WAM Capital Limited (ASX: WAM)'s 9.5% dividend safe?

A closer look at WAM Capital

WAM Capital is one of the listed investment companies (LICs) run by Wilson Asset Management and is in fact their flagship offering (hence the ticker). Since its inception in 1999, WAM has delivered an impressive return of 16.7% per annum – well above the market average.

It has been able to do this through focusing on "undervalued growth opportunities with a catalyst" on the ASX (usually within the small- to mid-cap space) and selling those opportunities when the catalyst is realised.

WAM Capital aims to pay out a significant proportion of the profits it receives from this process as dividends, in conjunction with the dividends it also receives from holding dividend-paying shares.

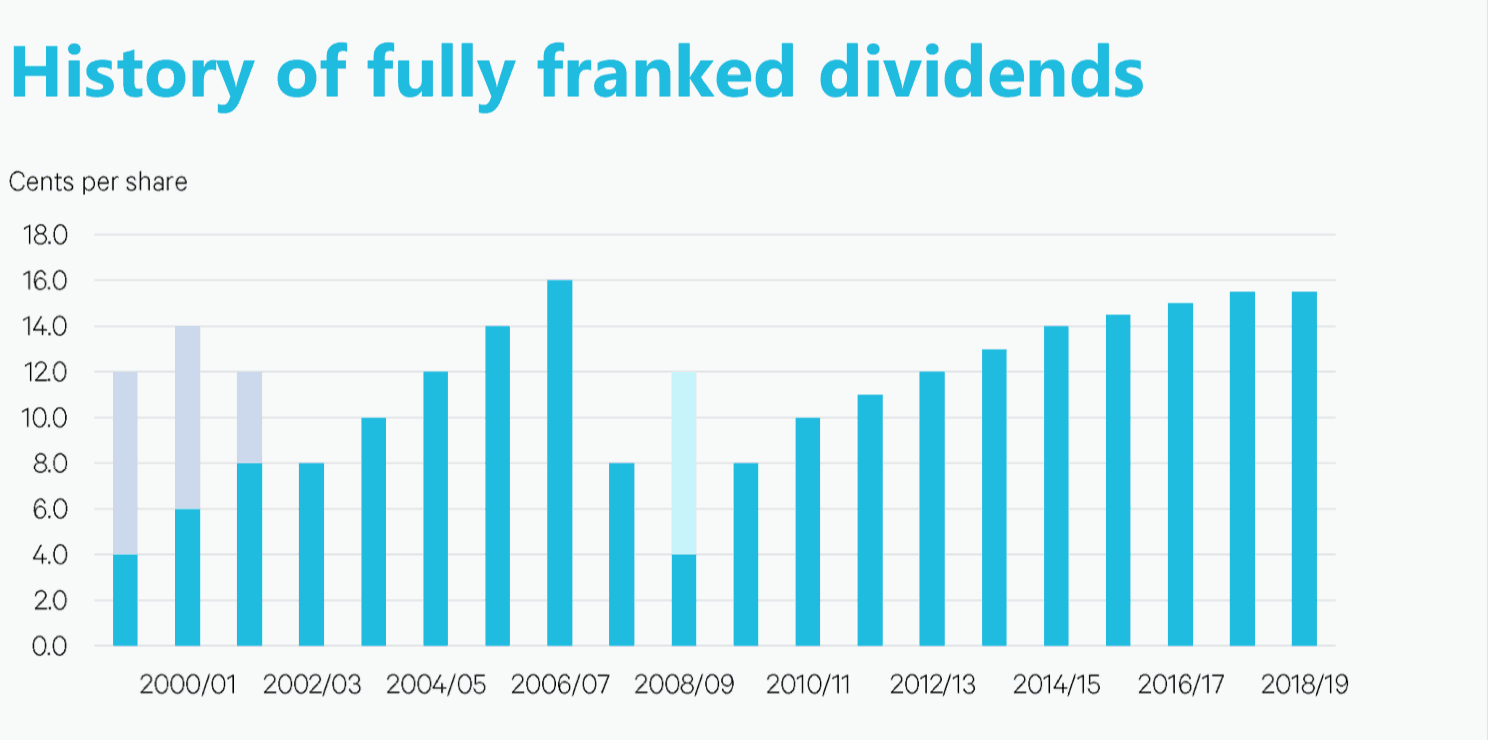

It has done so very successfully too, with WAM increasing its dividend payment every year since 2009, as you can see on the graph below

For FY19, WAM paid 15.5 cents per share to its investors. On today's price this gives WAM shares a yield of 6.65% – or 9.5% if you include the full franking credits.

Is WAM's dividend sustainable?

WAM's impressive performance has come to a halt over the last few years. Over the last 12 months, WAM's investment portfolio returned just 2.3%, which doesn't look good on any level, but especially not if you consider the S&P/ASX 200 accumulation index returned 8.6% in the same period. If you go back three years, WAM only returned 7.6% p.a., compared with the index's 11.1%.

These subdued returns mean that WAM isn't bringing in as much bacon as it once was. And that means less cash available to pay out dividends.

According to the companies' August investment update, WAM Capital has a profit reserve of 13 cents per share, as of 31 August. Considering the next WAM dividend of 7.75 cents a share will be paid on 25 October, before too long WAM will be left with a reserve of just 5.25 cents per share.

Foolish takeaway

By my judgement, WAM Capital will need to spend the remainder of the year bagging significant gains just to be able to fund next year's dividends – a rather unenviable position for an LIC to be in. Therefore, I don't consider WAM Capital's dividend safe, and think that all current WAM shareholders should consider this before adding to their positions.