It's safe to say that most of us are worried about the long-term environmental effects of climate change. Rising sea levels, changing climates, higher rates of natural disasters… it's all pretty scary stuff. But according to a report by Business Insider Australia, our retirements might also be at risk.

Frontier Advisors (an investment advice firm) has lowered their expected returns across all asset classes by 0.25% per annum going forward, with "the primary driver of this downward revision [being] the long-term impact on the global economy of climate change" according to Frontier's principle consultant Philip Naylor.

He added:

There are costs of transitioning to a low carbon economy, but the long-term costs of global warming and extreme weather events are far greater. There are a number of possible future scenarios with the degree of impact dependent on a range of different policy path responses policymakers make in the future.

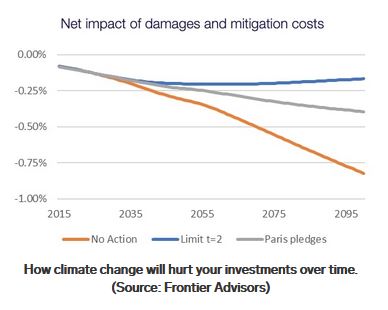

The 0.25% revision in expected returns is also assuming a 'best case' scenario in which governments around the globe do manage to significantly cut greenhouse gas emissions going forward and keep global warming to below 2 degrees. According to Frontier, the lost-wealth effects will be significantly higher if no action is taken (see the graph below), with a 'no action' scenario resulting in lost returns approaching 1% by the year 2100. The report notes that this might sound less than significant, but it would result in the loss of hundreds of thousands of dollars in lost returns in our retirement funds like superannuation.

This doesn't take into consideration the impact that rising sea levels and increased rates of natural disasters might have on other assets like the family home and other property – I personally wouldn't be too keen on buying a new beach house myself.

What can we do?

Well, if you are worried about climate change and its effect on not only the environment but on your retirement, the obvious solution is to keep up the pressure on our elected leaders and press for change. But closer to the world of finance, you can avoid buying shares of companies involved with climate change. Fossil fuel extractors like BHP Group Ltd (ASX: BHP) and Woodside Petroleum Ltd (ASX: WPL) might not be the best shares for you to own if you'd like to make a stand.

You could also consider an ethical ETF (exchange traded fund) like BetaShares Australian Sustainability Leaders ETF (ASX: FAIR), which invests in a basket of ASX companies that excludes fossil fuel miners, as well as other ethically questionable products like alcohol, gambling, uranium and tobacco.

There is no fate but what we make for ourselves, after all.