A lot of 'mum and dad' or retiree investors prefer 'blue-chip' shares due to the perception that they're less volatile or 'safer' compared to the mid cap or small-cap end of the market.

To an extent this is true as the larger a company is the less volatile its profits are likely to be, but it's impossible to hide from risk in the share market.

As large-cap shares can perform terribly over the short or long term and psychologically anchoring to 'blue chip shares' as 'less risky' can be a catastrophic mistake compounded if you hold onto long-term losers.

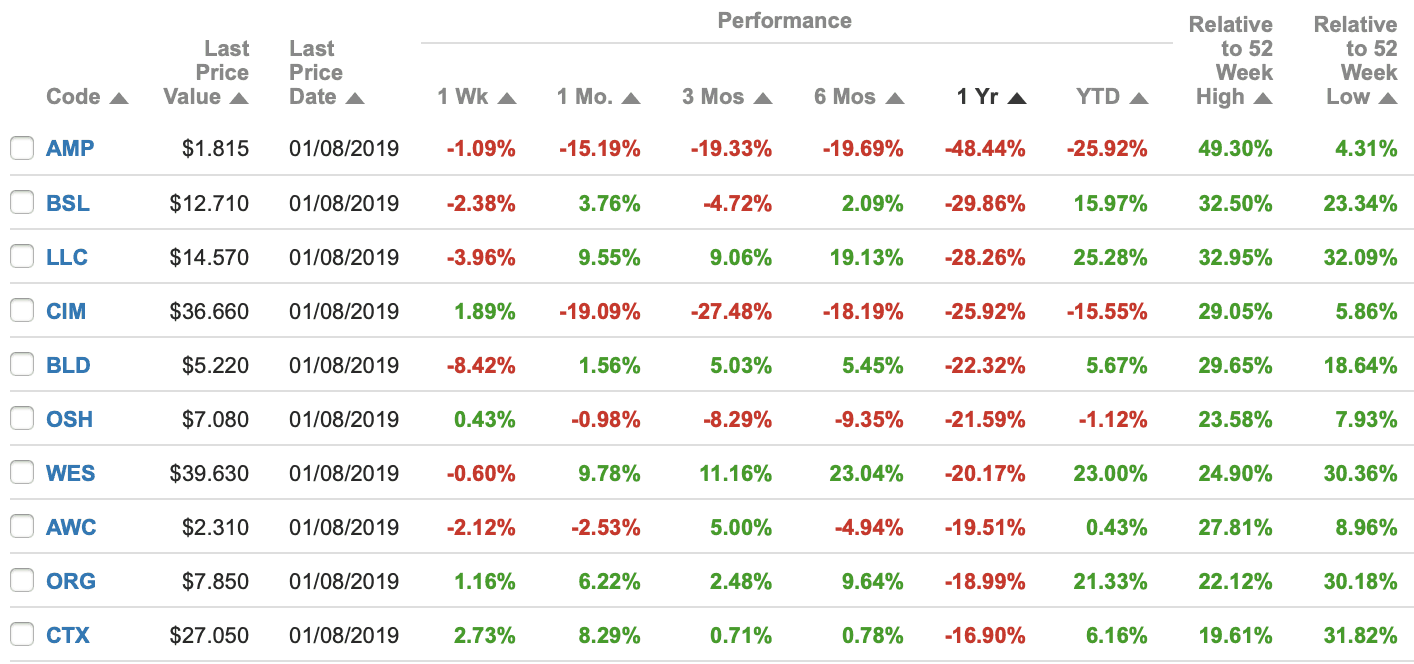

So let's take a look at the 10 worst 'large-cap' shares over the past 12 months and consider whether they could be buy, holds, or sells today. All stats according to Commsec as at Aug 2, 2019.

AMP Limited (ASX: AMP) is down 48.4% over the past year and down around 85% since 2007. The financial services group does not look any better than a 'hold' to me, despite its plans to try and rightsize the business.

Bluescope Steel Ltd (ASX: BSL) is down 30% on the back of the US/ China trade tariffs. I don't know enough about this business to hazard a guess as to the outlook for the shares though.

Lendlease Group (ASX: LLC) is the construction giant that has posted weaker-than-expected results recently and flagged problems at its engineering arm.

Cimic Limited (ASX: CIM) is another construction business that is suffering from weak construction activity and soft new home builds in Australia as the economy takes a turn for the worse.

Boral Ltd (ASX: BLD) is a building materials and cement business that is largely focused in the US where it has blamed a housing slowdown for weaker-than-expected results.

Oil Search Limited (ASX: OSH) is the PNG and Alaska-based LNG producer that recently blamed a softer-than-expected June quarter out of PNG on 'timing issues', among other factors.

Wesfarmers Limited (ASX: WES) is the investment conglomerate that's recently made bids for Kidman Resources Ltd (ASX: KDR) and Lynas Corporation Ltd (ASX: LYC). Investor confidence in the group's valuation appears to be sagging.

Alumina Limited (ASX: AWC) is the aluminium and bauxite producer investors are marking down on the back of sagging aluminium prices.

Origin Energy Ltd (ASX: ORG) is the LNG business and electricity retailer that continues to carry a net debt pile around $6 billion. This is not helping investor confidence.

Caltex Australia Limited (ASX: CTX) shares are down as its 'servo' or retail business underperforms and as refining margins come under pressure.

Outlook

Aside from AMP none of these businesses have lost more than 30% in the past year, which suggests the theory that large-cap or 'blue-chip' shares tend to carry a less risk than smaller businesses is generally correct.

Still, I would not suggest buying shares in any of these businesses on the basis that they are 'cheap' or turnaround opportunities.

In fact I reckon the businesses named below are probably far better bets….