Volpara Health Technologies Ltd (ASX: VHT) shares are locked in a trading halt today after the breast screening software business announced a fully underwritten $55 million capital raising to fund a A$21.1 million acquisition and provide more growth capital.

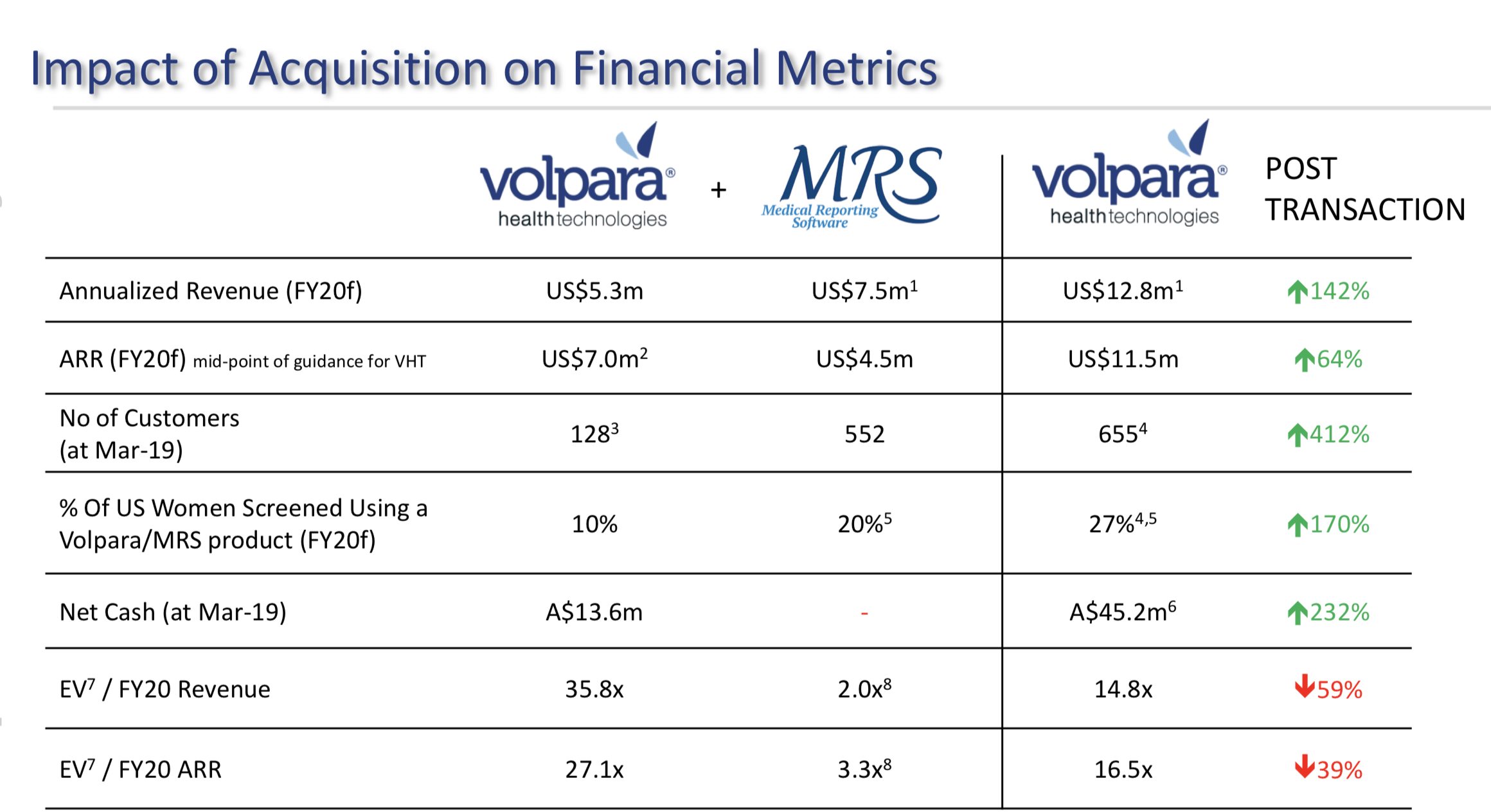

Volpara will acquire US-based MRS Systems, Inc. (MRS), which is also a breast imaging software business. MRS reportedly had around US$4.5 million of annual recurring revenue in FY19, or US$7.5 million in revenue if you include capital sales.

Volpara will complete the capital raising via a non-renounceable entitlement offer to institutional investors for $45 million and retail shareholders for $10 million at $1.50 per share, which is an 18.9% discount to the last closing price of $1.85.

Given the red-hot run Volpara shares have enjoyed in 2019, it makes sense for management to undertake the capital raising now as they can raise a lot more money by issuing less shares than they could have done earlier in the year.

Volpara included the chart below in its investor presentation, which shows how the financial arbitrage of raising cash on a 35.8x FY20 enterprise value (EV)/sales ratio to buy a business trading on just 2x FY20 EV/sales ratio makes the acquiring business better value.

Another business in the medical imaging and software-as-a-service space is Pro Medicus Ltd (ASX: PME), with its shares recently going on an even more unbelievable run than Volpara's recent performance.

For another share set to go on a red-hot run, take a closer look at this unique, little-known ASX stock…