These are challenging times to be a bank but the Australia and New Zealand Banking Group (ASX: ANZ) share price could find itself under more pressure than its peers as it's losing the home loan battle.

Despite this, the ANZ share price hasn't been underperforming other big banks – at least not yet. Shares in ANZ Bank have dipped around 1% over the past 12 months with the Commonwealth Bank of Australia (ASX: CBA) share price slightly behind, Westpac Banking Corporation (ASX: WBC) share price down around 9% and National Australia Bank Ltd. (ASX: NAB) share price lagging by 11%.

The latest data from the Australian Prudential Regulation Authority (APRA) is a further reminder why it will be hard for the big four banks to play catch up with S&P/ASX 200 (Index:^AXJO) (ASX:XJO) index.

Market share winners and losers

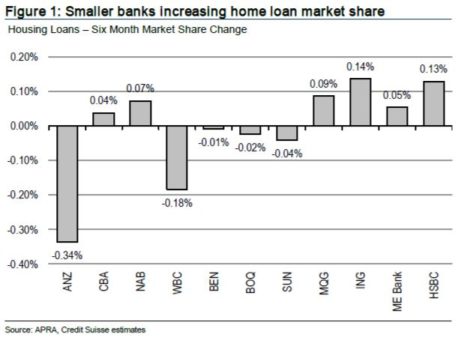

All four banks have lost market share to smaller banks when overall lending increased by 4.6% over the past year. The increase was led by corporate lending and home loans, while personal and cards fell.

In contrast, ANZ Bank's lending growth is trailing at 1.5% while loans for residential property fell 0.1%, noted Credit Suisse.

This makes ANZ Bank the biggest loser of the ground when it comes to share of the housing loan market.

On the flipside, NAB is the winner although it too is lagging the overall market. Total lending increased by 4.5% at the bank thanks to a big increase in home loans of 4.4%, which is better than all its peers.

NAB is arguably the most impacted of the big four by the Banking Royal Commission as it lost its chairman and chief executive in the aftermath.

At least shareholders can take some comfort knowing it's made the biggest home loan market share gain even though competition from smaller rivals is expected to persist.

Foolish takeaway

There's no doubt that valuations in the banking sector is looking cheap and the yields appear to be very attractive.

But the thing that holds me back is the worry that sector valuations will get cheaper as there's little light at the end of the tunnel for the banks.

There's also a distinct lack of positive catalyst in the nearer term that could spur bargain hunters to jump into the sector.

This doesn't mean there's nothing going their way. Easing wholesale funding costs will be welcomed by the sector but it's not enough to trigger a re-rating, not in my view.

At best, the big banks will be stuck in a holding pattern (meaning no rush to buy); and at worst, their share price will fall further due to the housing downturn, competition and a tightening balance sheet.