For those Fools that are looking to retire early (and let's be honest, who isn't!) the $1 million number is floated around as a widely accepted sort of benchmark.

There's something nice about the idea of joining the Millionaires' Club before retiring and if you base your figures off the 4% rule – with a 4% withdrawal rate on your investments in retirement – then the $1 million gives you a theoretical $40,000 perpetuity for the rest of your life.

But here's the thing – you don't really need to reach $1 million, and in fact, I estimate you could need just about half of that.

Calculating your income before you FIRE

The idea of being financially independent and retired early, or "FIRE", has grown in popularity in recent years as many people young and old look to escape the 9-5 desk job and pursue other aspects of life.

As is the nature of personal finance, everyone's retirement ambitions and lifestyle needs will be different, but I'm going to assume that Fools are targeting a $40,000 per annum income (which takes the 4% rule and applies it to the $1 million share portfolio).

The great thing about being in Australia is the superannuation system. While there are similar pension systems around the world including the USA's 401K, the Aussie super system is a FIRE aspirant's best friend.

Picture this: You have one investment curve for your current share portfolio assets, and another which represents your superannuation assets.

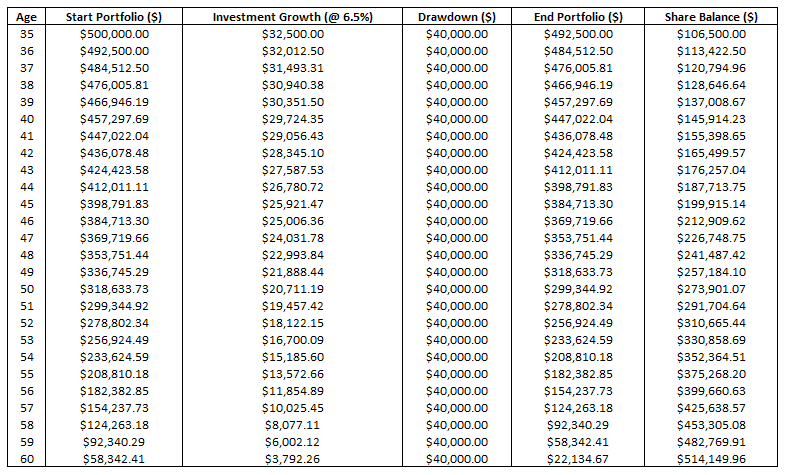

If you can reach a $500,000 share portfolio at the age of 35, and assuming a real (i.e. inflation-adjusted) return of 6.5% per annum, this portfolio would add an additional $20,000 in capital gains per year, less your $40,000 annual drawdown for a net loss of $20,000 per year in the first year.

You might be thinking, "but how can I retire early if I'm losing $20,000 per year or more of my portfolio at the age of 35?".

Great question, and this is where we bring in our second investment curve with superannuation.

Assuming you start with a super balance of $100,000 at the age of 35, then even once you've retired with no more contributions your super would still be compounding at a rate of 6.5% p.a. (which ignores the tax benefits of superannuation versus investments outside of super).

Your drawdown on the first portfolio would theoretically see you run down that share portfolio to $0 by the time you hit the age of 60, which is the current preservation (i.e. access) age for superannuation.

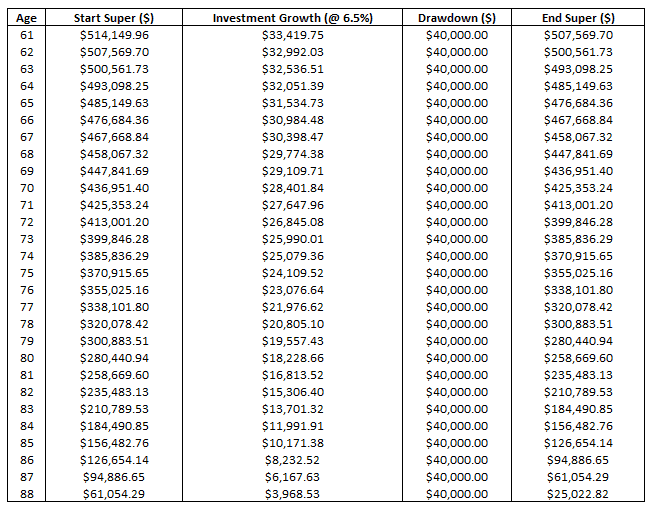

While your share portfolio would be worth zero, your super would have built to a very handy $514,000 nest egg which can then be accessed and drawn down at the same rate of $40,000 per year (see below).

So assuming these assumptions hold, you could retire at the age of 35 with a $500,000 share portfolio and a super balance of just $100,000.

That sounds like a much better deal than trying to reach $1 million to me.