The Big Four share prices were hammered in lower as the Financial Services Royal Commission unveiled widespread misconduct by many of Australia's largest financial institutions. So, are shares in the Big Four banks a bargain or a bust?

The dividend perspective

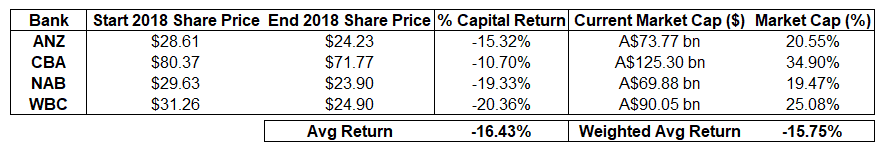

Shares in the Big Four fell an average of 16.4% last year led by Westpac Banking Corporation Ltd (ASX: WBC), which saw its share price fall more than 20% while National Australia Bank Ltd (ASX: NAB) wasn't far behind with a 19.3% loss.

For those Fools who prefer dividend investing, NAB remains the pick of the bunch with an ~8% dividend yield that is currently fully-franked. This compares favourably to the likes of Westpac (~7%), as well as Australia and New Zealand Banking Group Ltd (ASX: ANZ) and Commonwealth Bank of Australia Ltd (ASX: CBA) which currently yield ~6% each.

However, before diving into NAB shares it's worth looking at my previous article here which looks at the possibility of NAB having to trim that dividend to meet its minimum regulatory capital requirements by the start of next year.

Given that uncertainty, I'd be considering Westpac as the next best banking dividend stock available on the market. Westpac recently announced it would be reneging on its stubborn plan to keep its wealth management arm (BT Financial Group) and this could hamper the group's potential revenue growth in coming years.

Question marks over future earnings growth

With credit lending momentum slowing, the big question for all the banks is where will the money supply will come from in the next 12-24 months. The potential Royal Commission penalties for misconduct that continue to loom over the sector and proposed changes to the mortgage broking industry present interesting challenges for the banks, with the latter potentially driving more mortgage volume through the bank's direct lending channels.

ANZ has arguably been the most prudent of the banks throughout the last 12 months and has slowly embarked on its $3 billion share buyback scheme which it completed on Friday. Despite being the smallest of the lenders, ANZ has largely escaped a lot of the idiosyncratic criticism to come out of the Royal Commission and looks relatively cheap with a P/E ratio of just 11x earnings.

CBA is marginally more expensive at 14x earnings, but with a market cap of $125 billion, it's hard to write off the nation's second largest public company in terms of future growth.

At this point in the cycle I'd be looking at banking exposure purely for the dividends rather than the growth, and even that is a somewhat risky play given potential changes to franking credits in coming months.

For those who are more growth-inclined, it's worth checking out this buy-rated stock that could take a booming $22 billion by storm in 2019.