The Commonwealth Bank of Australia (ASX: CBA) share price will be on watch on Wednesday after the banking giant provided the market with a trading update ahead of its annual general meeting in Brisbane today.

How did Commonwealth Bank perform in the first quarter?

According to the release, the bank continued to show resilient business performance in the first quarter of FY 2019.

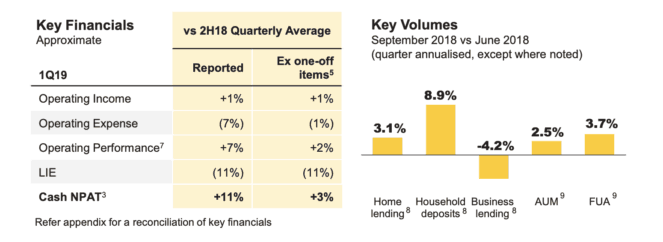

As you can see above, during the first quarter the bank delivered a 1% increase in operating income compared to the quarterly average of the last two quarters. Cash net profit after tax rose 11% on a reported basis and 3% excluding one-off items.

Operating expenses were down 7% on a reported basis, or 1% excluding one-off items. The latter was due to the timing of investment spend and software impairments in the comparative period.

Another positive was that the bank's Loan Impairment Expense (LIE) fell to 11 basis points of its Gross Loans and Acceptances or $216 million. Low corporate LIE reflected some single name improvements, sound portfolio credit quality and continued IB&M portfolio optimisation.

This ultimately led to the bank finishing the period with a CET1 capital ratio of 10%. Though, once its announced divestments are complete, Commonwealth Bank's CET1 capital ratio will rise to 11.2%. This puts it well ahead of the 10.5% ratio needed to meet APRA's 'unquestionably strong' benchmark by January 2020.

CEO Matt Comyn appeared to be pleased with the way the bank was performing. He advised that the "fundamentals of our business remain strong, highlighted in this quarter by continued deposit growth, sound credit quality and balance sheet strength."

In addition to this, Mr Comyn stated that the bank has been focused on delivering on its response to the APRA Prudential Inquiry. He believes the significant program will ultimately ensure that Commonwealth Bank is a better and more customer-focused bank.

Finally, Comyn believes that recent divestments and demergers "represents another important milestone in our strategy to focus on our core banking businesses and to create a simpler, better bank."

Should you invest?

I thought this was a strong update from Commonwealth Bank and would expect the market to respond positively to the news today.

And while I do think the bank is worth considering as an investment, I still see more value in the shares of Australia and New Zealand Banking Group (ASX: ANZ) and Westpac Banking Corp (ASX: WBC).