The share price crash in AMP Limited (ASX: AMP) is like a train wreck that you can't look away from as the stock struggles to stay ahead of last week's record low.

What's worse, I have a feeling the stock is heading under the psychologically important $3 level in the coming weeks even though our largest wealth management group is trading on beaten down valuations as its shares have shed 41% since the start of the year compared to a 1% plus gain by the S&P/ASX 200 (Index:^AXJO) (ASX: XJO) index.

Make no mistake – the brutal sell-off of the stock is not a crisis in value but a crisis in confidence. This means valuation won't save the stock.

But there might be a way to turn around its fortunes and drive its share price up to around $5 a pop, according to Morgan Stanley. The broker believes a carve-up of the enlarged group may be the best way to trigger a re-rating in the embattled group.

After all, there's good precedence to believe spin-offs and divestments will bring back the believers just as Woolworths Group Ltd (ASX: WOW) did with the sale of Masters and BHP Billiton Limited (ASX: BHP) with South32 Ltd (ASX: S32).

Investors won't touch AMP because they are worried about how some parts of the business will be significantly impacted by regulatory and legal headwinds stemming from the Hayne Royal Commission, which has also led to a de-rating in the big banks like Commonwealth Bank of Australia (ASX: CBA) and National Australia Bank Ltd. (ASX: NAB).

This is why splitting AMP may be the best way to salvage value for shareholders as not all parts of the business are potentially cancerous.

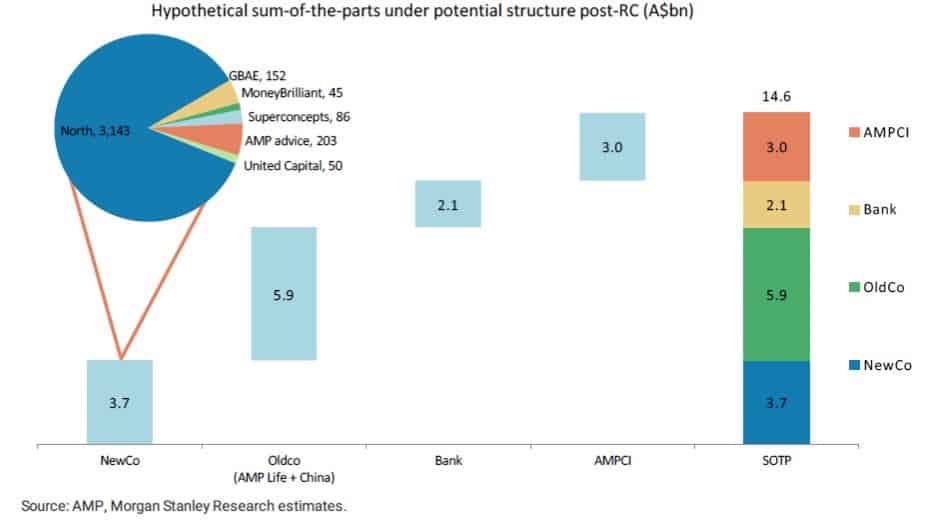

Worth More In Parts: Rethinking AMP could unlock value at ~$5 a share ($14.6 billion)

But separation won't be easy, and the group may need to be carved into three or four different entities, based on Morgan Stanley's analysis.

AMP's digital assets like its marketplace platform will be housed in "NewCo". These assets were built for the future but are lost in the current structure, noted the broker.

AMP's Goals Based Advise Engine, which will be part of NewCo may even benefit from new potential regulations post the Royal Commission as it could become a key market infrastructure.

The group's embattled insurance business will be held in "OldCo". This entity will be run for value and represents a potential turnaround play with the added exposure to China (through its joint venture China Life Pension Company).

The broker considers AMP Capital Investors (AMPCI) to be non-core and will be a standalone entity. The question is whether AMP Bank should be part of this grouping or an independent entity on its own.

On another note, I suspect splitting AMP will heighten takeover interest and some parts of the group may not stay independent for long. There's long been a strong appetite for someone, like the big banks, to swallow the group but its existing structure is just too much of a mouthful.

The jury is still out on whether this is the best or only way for AMP to save itself and Morgan Stanley makes no judgement on the likelihood of this multi spin-off happening.

However, it's clear that AMP's management will need to make dramatic changes if it wants to get back into investors' good books.