In morning trade the Mayne Pharma Group Ltd (ASX: MYX) share price has rocketed 14% higher following the release of the pharmaceutical company's results for the 12 months ended June 30.

Here's how Mayne Pharma performed in comparison with FY 2017:

- Revenue came in 7% lower at $530.3 million.

- Adjusted EBITDA fell 20% to $165.3 million.

- Adjusted net profit after tax fell 33% to $60.3 million.

- Reported net loss after tax of $133.9 million.

- Cash flow from operations of $121.5 million.

- Outlook: Positive outlook for FY 2019 with a more stabilised retail generic pricing environment.

While on the face of it this looks like a disappointing result, it is actually a massive improvement on the first half of FY 2018.

Compared to the first half, second half revenue rose 18% to $287 million, adjusted EBITDA increased 35% to $94.8 million, and adjusted net profit jumped a whopping 171% to $44.1 million. Incidentally, the adjusted result excludes non-recurring asset impairments, abnormal stock adjustments and Doryx returns, restructuring expenses, and US tax items.

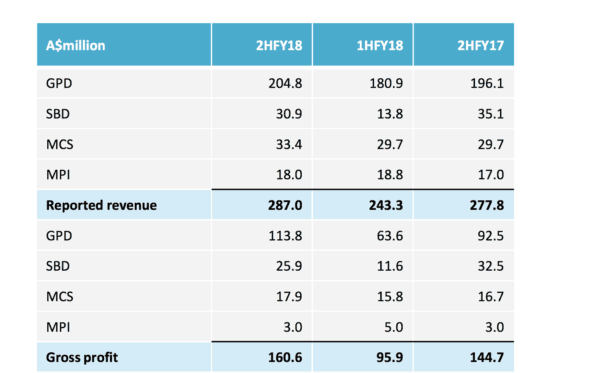

As you can see below, there was a major improvement in the performance of its key Generic Products Division (GPD) in the second half.

The improved performance has been driven by the easing of price deflation that peaked in calendar year 2017. Management advised that price deflation appears to be returning to normalised levels now. The strong second half wasn't enough to deliver full year growth for the division, though. GPD revenue fell 8% to $385.7 million and gross profit fell 19% to $177.4 million in FY 2018.

The company's Specialty Brands Division (SBD) had a tough year. Revenue fell 28% and gross profit fell 36% due to a disastrous first half caused by abnormal Doryx returns. Pleasingly, though, these abnormal returns did not recur in the second half.

Mayne Pharma's Metrics Contract Services business delivered a strong result. Revenue increased 9% to $63.1 million and gross profit rose 5% to $33.7 million in FY 2018. Management advised that the growth in revenue and margin was driven by commercial manufacturing and increased late-stage development work including clinical trials manufacturing.

Finally, the Mayne Pharma International (MPI) division also performed well in FY 2018. It achieved revenue growth of 7% to $36.8 million and gross profit growth of 18% to $8 million. Growth in Australia was driven by aspirin, injectables, itraconazole, oxycodone and new product launches. Whereas its Rest of World category benefited from improving morphine sulfate and itraconazole sales.

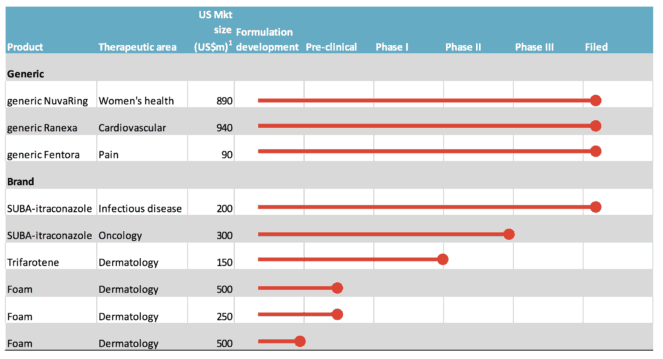

Looking ahead, the company has a lucrative pipeline of products that could drive growth over the medium term. This pipeline and the market size of each product is shown below:

Outlook.

According to the release, management believes that its outlook is positive. It stated that:

"The outlook is positive across the Group with a more stabilised retail generic pricing environment, an established specialty sales platform in US, anticipated new product launches, the acquisition of generic Efudex, portfolio optimisation and the pipeline of committed contract service business expected to be key drivers of near and long-term growth."

Should you invest?

Mayne Pharma has had a terrible couple of years due to the impact of price deflation in the generic drugs market. But there are signs that it is over the worst of it now and looks likely to return to growth in FY 2019.

This could make it worth considering Mayne Pharma even after today's impressive gain. In addition to Mayne Pharma, I think industry peer CSL Limited (ASX: CSL) could be a great investment as well.