The CSL Limited (ASX: CSL) share price rose 2% to $205.39 following the announcement of bumper results this morning. For the full year to 30 June 2018, CSL reported 15% growth in revenue to US$7.6 billion (all figures in USD) and 29% growth in net profit after tax to $1.73 billion.

This equates to diluted earnings per share of $3.81 and dividends per share of $1.72, unfranked. CSL ended the year with approximately $3.5 billion in net debt. Research development expenditure fell slightly to just below 10% of revenue, with $702 million spent on R&D in the year.

Much of the growth was driven by wider margins, with earnings before interest and tax (EBIT) margins rising from 25% to 30%. CSL's return on invested capital (ROIC) improved from 24.5% to 25.9%.

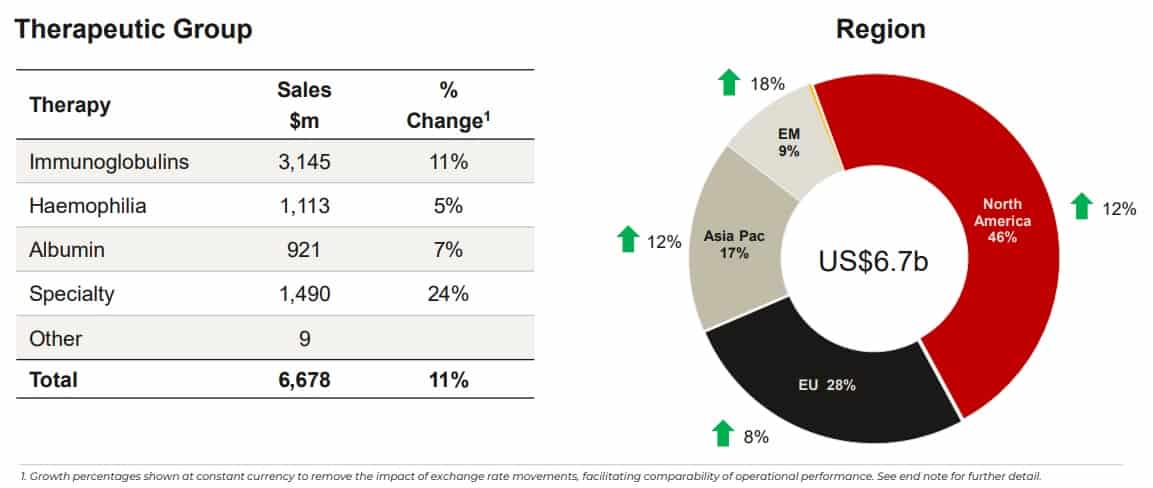

During the year CSL also delivered growth across almost every aspect of its business, with CSL Behring delivering sales growth in every region:

Management also reported strong growth in the numbers of plasma collection centres being opened during the year. Plasma collection is a good leading indicator of growth in CSL's blood products – CSL collects the plasma to turn it into medical products for use in patients.

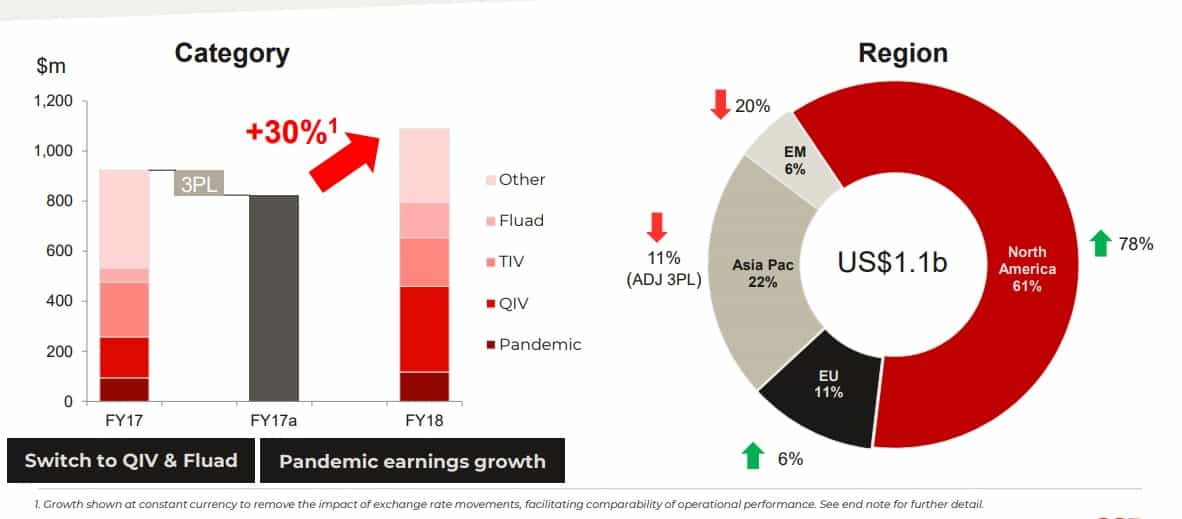

Recently acquired vaccine business Seqirus also delivered strong growth, growing its overall sales despite sharp falls in emerging markets and Asia Pacific:

In its outlook for financial year 2019 (FY19) CSL guided for above-market collections growth, which means it will be attempting to grow market share in plasma collection. CSL noted that supply of plasma remains a limiting factor for the industry.

Management also guided for approximately $1.2 billion of capital expenditure as well as a ~$200 million increase in R&D expenditure to bring research spending up to 10% of revenue.

CSL has several exciting products in Phase 3 trials this year and appears set to grow for the near future.

At $200 a share it's not cheap by any measure, but I wouldn't be inclined to sell any shares.