The Afterpay Touch Group Ltd (ASX: APT) share price has gone gangbusters again this afternoon after the buy now pay later merchant updated the market with more incredible growth numbers.

Let's take a look at some of the impressive stats that have sent the stock 25% higher today and more than 300% higher over just the past year.

- Afterpay processed more than $2.18 billion in end-user sales in FY 2018, up 289% on FY 2017

- Sales processed for the quarter ending June 30 2018 grew 39% over the quarter ending March 31 2018 to hit $736 million

- The group now has 16,500 retailers and a staggering 2.2 million customers signed up to Afterpay. That's nearly 1 in 11 Australians based on a population of 25 million!

- The group reports it now processes more than 10% of all the physical online retail in Australia

- Since launching in the U.S in mid-May the group has already signed up more than 400 retailers and processed $11 million in underlying sales in June 2018

- FY 2018 revenue is expected to be $142 million

- FY 2018 group EBITDA is expected to be $33 million to $34 million

I think it's fair to say Afterpay's CEO Nick Molnar has been working through lunch over the past year given the astonishing growth and execution delivered by a business that only launched properly back in 2015.

The users of the service still use debit or credit cards such as those offered by the Visa or MasterCard duopoly, but it seems the buy now, pay later offering of Afterpay is now much more popular for younger shoppers than the idea of taking on buy now, pay later, credit card debt.

The difference perhaps being that goods and services seem more affordable broken down into quarters rather than paying the lot upfront.

As such executives at the Visa and MasterCard duopoly that profit from credit card spending may have to sit up and take notice of a start-up disrupting the payments industry in Australia at least.

Is there a chink in its fintech armour?

I must admit I thought the group might run into trouble if it was forced to properly verify its 2.2 million users' ID as this could be an onerous and costly task.

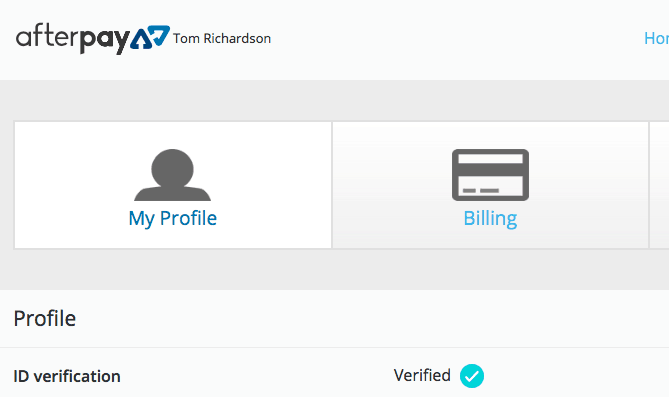

For example it took me less than 2 minutes to sign up for an account this afternoon with just my date of birth, mobile number and residential address, after which I received a message confirming my ID had been verified pretty much instantaneously.

All this without me providing a single piece of actual photographic ID for example.

Afterpay reported today:

— External third-party ID Verification has been implemented in partnership with Illion to supplement Afterpay's proprietary systems

— The ID verification process has been designed to minimise customer impact and is largely automated and instantaneous for the majority of customers

Verified, that hardly took more than a minute!

Clearly, whatever Afterpay has come up with to 'verify its users' ID' is beneficial to its business as it seems to be at a minimal cost relative to the task.

And if it satisfies the regulators who am I to argue with it.

Still, I have a suspicion that ID verification and the regulatory environment are the potential chinks in its armour as other providers of financial services such as FX remitters or money transfer businesses are held to a higher standard depending on their regulatory status.

However, you can't argue with the vertiginous Afterpay share price chart over the past 18 months.

If only I owned Afterpay shares, rather than just writing and tweeting about it….