Block Inc (ASX: SQ2) shares are marching higher again today.

Shares in the global S&P/ASX 200 Index (ASX: XJO) buy now, pay later (BNPL) stock – which acquired Afterpay in January 2022 – closed yesterday trading for $115.78. During the Friday lunch hour, shares are swapping hands for $116.89 apiece, up 1.0%.

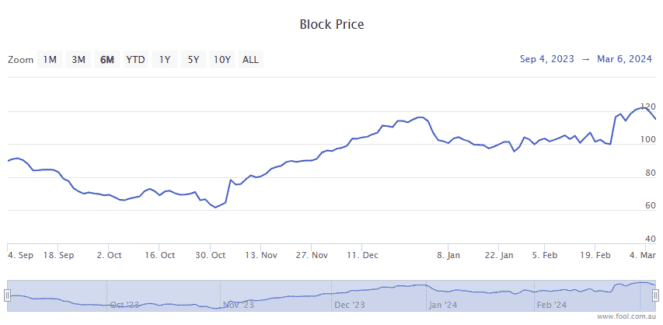

That sees Block shares up a whopping 92.5% since the closing bell sounded on 31 October!

For some context, the ASX 200 (breaking into new all-time highs today) is up 15.4% over this same period.

Here's what's been piquing ASX 200 investor interest.

What's boosting Block shares?

The ASX 200 BNPL stock is getting some tailwinds today as investors are increasingly optimistic about the outlook for interest rate cuts, both in Australia and in the United States.

The case for a rate cut from the RBA was bolstered earlier this week when the ABS released some very lacklustre growth figures for the Aussie economy.

And in the US, Fed chair Jerome Powell said that while the world's top central bank was still "waiting to become more confident that inflation is moving sustainably at 2%… we're not far from it".

Block shares, like other BNPL stocks, have proven to be particularly sensitive to higher interest rates. Powell's dovish words helped Block's US listed stock close up 2.2% on the New York Stock Exchange (NYSE) overnight.

The big rally for Block really kicked off in early November. That's when the company boosted its guidance and announced cost cutting measures, including staff reductions.

And the rally picked up pace again on 23 February, when the BNPL company reported its fourth quarter results.

Highlights included a 24% year on year increase in net revenue to US$5.77 billion. And gross quarterly profit of US$2.03 billion was up 22% from Q4 2022.

The fast-rising Bitcoin (CRYPTO: BTC) price also bolstered the bottom line. Block's Bitcoin gross profit increased 90% year on year to $66 million.

That could be helping Block shares with their ongoing gains this week.

According to data from CoinMarketCap, Bitcoin reached an all-time high on Wednesday of US$69,170.63. It's still hovering near that record, with the world's top crypto currently valued at U$67,173.56.

Have you been following along?

Every month the Motley Fool's analysts scour the boards for top stock picks.

And Block made that list last month.

Motley Fool analyst Tony Yoo tipped Block shares to outperform back on 10 February. At the time the stock was valued at $105.19, 11.1% below current levels.

"The financial services company is on the way up after cleaning up its act in recent months," Yoo said.

He added:

Management has cut costs, reduced staff share issuances, and generally placed a greater emphasis on cash flow. The revival in the Bitcoin price has helped too, with co-founder Jack Dorsey a firm believer in cryptocurrencies.