With the S&P/ASX 200 Index (ASX: XJO) rising 13.8% over the four months, many of the more obvious quality stocks have become expensive.

As such, it's not a bad idea to check out the shares that are struggling right now to see if there is a bargain to be bagged for long-term investors.

Here are two that Shaw and Partners portfolio manager James Gerrish and his team have identified:

'A good outcome for shareholders'

Diversified mining company South32 Ltd (ASX: S32) has seen its share price decline almost 12% so far this year.

It's a painful 37.3% fall if you go back 12 months.

Gerrish admitted the February results didn't flatter, but feels the outlook is positive.

"They reported solid earnings, a slight beat on low expectations but costs remained an issue, which has led to the stock drifting lower," he said in his Market Matters newsletter.

"We expect a production uplift in the 2H of FY24, and higher production will help with unit costs, putting them in a better position."

There was an intriguing catalyst last week as well.

"The main news… was the sale of their Illawarra Met Coal operation for up to US$1.65 billion ($2.54 billion)."

The critical detail was that there is a large upfront cash payment of US$1.050 billion, with US$250 million deferred and a US$350 million conditional component.

"The price is a great one and a good outcome for shareholders given the operational complexities and risks, along with rehab liabilities at IMC.

"We like the risk-reward on offer by South32 below $3, with a 20% to 30% bounce being our preferred scenario."

The South32 share price closed Tuesday at $2.94.

These ASX shares might have taken enough punishment

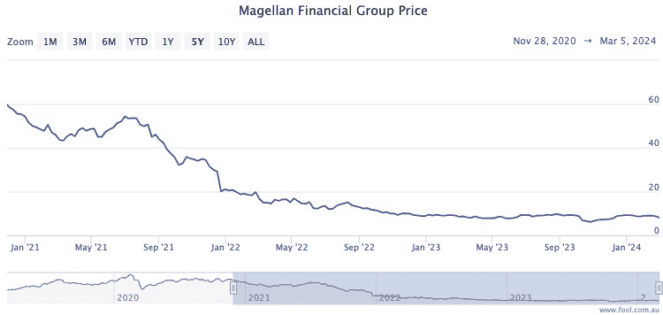

After the hammering it's taken the last few years, it might take some courage to buy Magellan Financial Group Ltd (ASX: MFG).

But Gerrish's team feels like the time is right with the price hovering in the low $8s.

"Market Matters continues to see attractive value in the individual components of MFG, including the much-discussed potential capital management due to the company's strong balance sheet with cash and investments amounting to over 50% of its market cap, in our view."

Last month the investment firm reported a "solid first-half beat".

"The profit of $93.5 million was well ahead of the $66 million consensus estimate," said Gerrish.

"Although it was driven by capital gains rather than a strong operational performance from the fund manager."

His team also likes the appointment of the new boss.

"We liked the announcement that Sophia Rahmani, a well-credentialed leader from boutique fund manager Maple-Brown-Abbott, would take on the CEO role.

"Now back around $8, following a solid result, it's looking increasingly attractive."