The NVIDIA Corp (NASDAQ: NVDA) share price has been on an incredible run. It's impressing the market with its strong financial growth. In this article, I'm going to look at whether this is the sign of a stock market bubble.

It's a fantastic time to own NVIDIA shares and be involved in any company that has genuine exposure to artificial intelligence growth.

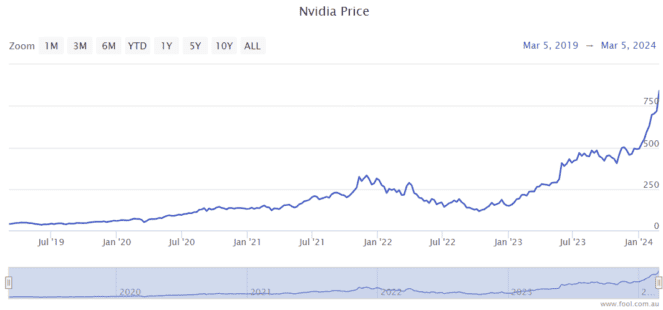

Since the start of 2024, the NVIDIA share price has risen 77%. The last year has seen a 262% increase for the company. In five years, it has gone up more than 2,100%.

Is this a stock market bubble?

Some investors may think it's fair to compare this period to the 1999 dot com bust. Businesses that were involved with the internet that had hardly any revenue (or none at all) were being valued astronomically.

But, NVIDIA, Microsoft and many others are generating lots of revenue.

A few weeks ago, NVIDIA reported quarterly revenue of US$22.1 billion, up 22% quarter over quarter and up 265% year over year. FY24 full-year revenue was up 126% to $60.9 billion.

It also said that underlying earnings per share (EPS) was US$12.96, an annual increase of 288%.

NVIDIA revealed it's expecting the FY25 first-quarter revenue to be around US$24 billion, which would be a quarter-over-quarter increase of 8.6%.

It's demonstrating real growth, making huge revenue and posting enormous growth in its profit. The current forecast on Commsec puts the NVIDIA share price at 36 times FY25's estimated earnings and 30 times FY26's estimated earnings.

To me, those sorts of forward price/earnings (P/E) ratios are not excessive at all considering how quickly it's growing. It could deliver stronger growth than what investors are expecting. Microsoft shares are trading at 31 times FY25's estimated earnings.

I'm not going to call these stocks cheap, and the higher interest rate environment does raise the question of what multiple is fair in the current economic environment.

However, in three years, these large tech stocks may have materially grown earnings and interest rates could be materially lower.

Billionaire investor recently commented on LinkedIn about the stock market bubble question:

When I look at the US stock market using these criteria, it—and even some of the parts that have rallied the most and gotten media attention—doesn't look very bubbly.

The Mag-7 is measured to be a bit frothy but not in a full-on bubble. Valuations are slightly expensive given current and projected earnings, sentiment is bullish but doesn't look excessively so, and we do not see excessive leverage or a flood of new and naïve buyers. That said, one could still imagine a significant correction in these names if generative AI does not live up to the priced-in impact.

We can look for instance at Nvidia today versus Cisco during the tech bubble. The two cases have seen similar share price trajectory. However, the path of cash flows has been quite different. Nvidia's two-year forward P/E is around 27 today, reflecting that, even as the market cap has grown ~10x, earnings have also grown significantly and are expected to continue to grow over the next year or two because of actual orders that we can validate. During the tech bubble, Cisco's two-year forward P/E hit 100. The market was pricing in far more speculative/long-term growth than we see today.

My 2 cents on share valuations

I'm not an expert on US shares or AI. But, businesses that are delivering strong long-term growth are likely to see rising share prices as the market realises their potential.

In my opinion, most of the large US tech companies are delivering earnings growth that can justify the investor excitement we're seeing. Hence, I don't think this is a stock market bubble.

Are other industries and businesses reporting numbers that justify their current share prices? That's what investing in shares is all about – making decisions about price and value.

I was very excited about share prices in late October 2023 and early November 2023, with loads of opportunities. I'm a lot less excited now. I believe business profits and share prices can rise over time from here, and there are still some undervalued areas, in my opinion, while some areas look challenged.

Keep in mind that if economies remain strong, interest rates are likely to remain higher for longer.

For a five-year investment, I'd rather buy a name like Nvidia, Microsoft or Alphabet over Commonwealth Bank of Australia (ASX: CBA) or BHP Group Ltd (ASX: BHP) because of the potential earnings growth for those US tech names.