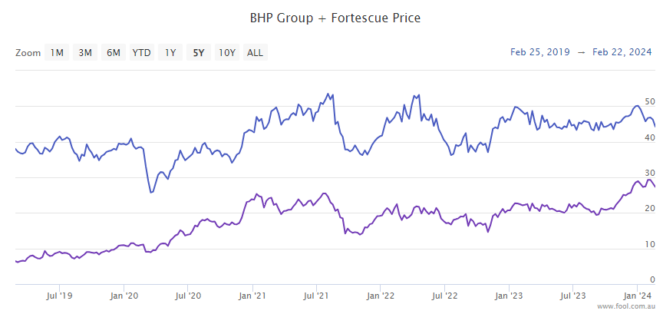

BHP Group Ltd (ASX: BHP) shares and Fortescue Ltd (ASX: FMG) shares are both known for paying big dividends to shareholders. But which of the ASX mining giants is a better buy?

Almost all of Fortescue's revenue comes from iron ore, for now at least. BHP is involved in a number of different commodities, including iron ore, copper, nickel and coal.

Most of the time, diversification is a good thing. But, BHP's nickel exposure has caused some pain after the recent multi-billion write-down of the nickel division on its balance sheet.

They're both big enough that I don't think size makes much difference for a choice. They're both excellent miners, though Fortescue's iron ore production is generally lower-grade.

Dividend yield

Both businesses just reported their FY24 half-year results.

BHP decided to cut its dividend by 20% to US 72 cents, while Fortescue hiked its dividend by 44% to A$1.08 per share. Despite BHP being significantly larger by market capitalisation than Fortescue, the Fortescue dividend is almost the same size in dollar terms.

Of course, if the iron ore price were to fall, BHP's other commodities (such as copper) could help offset that pain.

According to the estimate on Commsec, for the full 2024 financial year. Fortescue could pay a grossed-up dividend yield of 10.8% and BHP could pay a grossed-up dividend yield of 7.7%.

For investors purely focused on short-term dividend income, Fortescue seems like the more appealing choice.

Green efforts

Both of these mining companies provide commodities that the world needs. Iron ore is an essential element of steel, which is used in construction, car manufacturing, infrastructure and many more uses.

BHP has expanded in copper, and it's working on a large potash project in Canada called Jansen. I think both copper and potash have attractive futures – copper is needed for electrification, while potash is a fertiliser that supposedly has less emissions.

Fortescue is working on a myriad of different green energy initiatives, including the production of green hydrogen and green ammonia. It's also building a division that works on producing high-performance industrial batteries.

If the world is to reach net zero, it will need to replace the fuel used by planes, boats and other heavy machinery. Green hydrogen and green ammonia could be the answer if produced in large enough quantities. I like this move by Fortescue because it diversifies which customers it's selling to and opens it up to another commodity.

Valuation

Fortescue isn't generating any earnings from its green division yet, but the Fortescue share price is only priced at 8.4x FY24's estimated earnings, according to the projection on Commsec.

The BHP share price is valued at 10.5x FY24's estimated earnings, so it's priced higher than Fortescue.

Foolish takeaway

With the iron ore price as high as it is, above US$120 per tonne, I wouldn't be jumping on either ASX iron ore share. But, on the face of it, Fortescue looks like the better choice, particularly if the green energy initiatives pay off.