You don't need a massive amount of cash to kick off an investment that could pay out a perpetual second income.

Don't believe me?

Let's start with $20,000 and take it through this hypothetical:

Save, save, save, invest, invest, invest

Say you constructed a well diversified portfolio of ASX shares with that $20,000.

Then you saved hard and managed to add $400 to it each month.

If that portfolio can manage a compound annual growth rate (CAGR) of 13%, then you'll be raking in that second income in a matter of years.

Is 13% achievable?

I don't see why not.

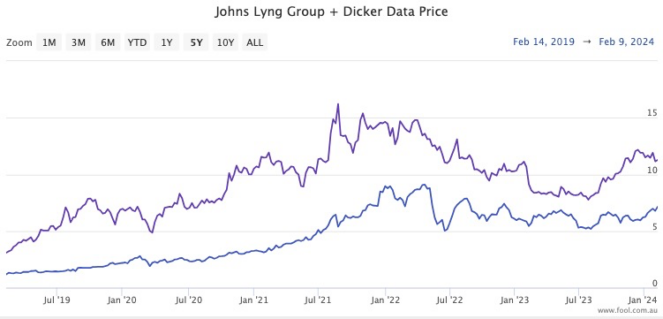

If you listen to sensible advice and pick quality stocks like Johns Lyng Group Ltd (ASX: JLG) and Dicker Data Ltd (ASX: DDR), you'll have done most of the hard work.

Over the past five years, Johns Lyng shares have returned a CAGR of 43%, while Dicker has brought in 30% per annum. The latter is paying out a 3.9% fully franked dividend yield on top of that.

These types of champions mixed with some lukewarm picks and the obligatory duds could very well provide you an overall 13% return each year.

Now sit back as the second income rolls in

Going back to the $20,000 portfolio with $400 added monthly, if that grows at 13% per annum then it will be worth $156,306 after just 10 years.

At that point, if you decide to stop reinvesting the returns and cash it in each year, you will receive an annual second income of $20,319.

That is an average of $1,693 each month for the rest of your life.

Now, if you are still young and you have patience, perhaps you want to let that stock portfolio grow for 20 years before squeezing passive income out of it?

Twenty years of growth will turn the pot into $619,006, which equates to a massive annual second income of $80,470.

In monthly terms, that's an amazing $6,705.

Enough to retire on, right?

Perhaps then it won't be a second income, but your first.

Good luck with your investments.