Sometimes even good companies fall out of favour with investors.

It might be that the economic conditions aren't quite right for them in the short term, or they might be dealing with some one-off problems.

But when it becomes clear that the problems are not chronic and the stock starts poking up, it could be an excellent buying opportunity for investors.

Here are two such S&P/ASX 200 Index (ASX: XJO) stocks that the experts are rating as buy this week:

The next month could 'ignite demand'

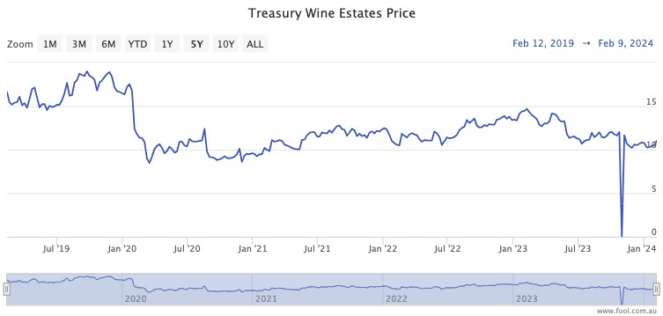

Treasury Wine Estates Ltd (ASX: TWE) lost a major export market four years ago when China instituted punitive tariffs on imported wine in retaliation for Canberra's call for an enquiry into the origins of COVID-19.

Now that diplomatic relations have thawed somewhat, there could be a revival.

"A review of punitive tariffs imposed on Australian wine in China is expected to be completed at the end of March," Shaw and Partners senior investment advisor Jed Richards told The Bull.

"Lifting tariffs, or significantly reducing them should ignite demand for Treasury Wine's Penfolds brand."

The market has started to appreciate that the business is solid outside of the China issue, pushing the Treasury stock price up more than 9% since early January.

Richards said that Treasury Wine has "a strong track record".

"The company offers strong brands and a quality management team."

Many of his peers agree. A whopping 12 out of 14 analysts surveyed on CMC Markets currently rate the stock as a buy.

The ASX 200 stock looking forward to rate cuts

The Macquarie Group Ltd (ASX: MQG) shares have merely moved sideways since a brief period in late 2021 when the investment bank overtook Westpac Banking Corp (ASX: WBC)'s market capitalisation to technically enter the Big Four.

Baker Young analyst Toby Grimm is convinced transitory headwinds are now behind Macquarie.

"Downgrades in mid to late 2023 were due to difficult corporate transaction conditions," he said.

"However, we believe financial conditions are improving."

A likely pivot from central banks around the world will set up favourable conditions for Macquarie in the coming years.

"The global outlook includes interest rates cuts, which, in our view, positions this diversified financial services company to benefit from improving transaction volumes and earnings in fiscal years 2024 and 2025."