Even for longtime readers of The Motley Fool, the question of how much one should invest persists.

Like anything in life, that depends on your personal goals.

How does a passive income of $1,000 each month sound?

If that's about the level you wouldn't mind achieving, let's work backwards to see how much you need to invest.

How to grab $12,000 a year for doing nothing

A monthly income of $1,000 would require an annual payout of $12,000.

For ease of calculation, if you're maintaining a 12% compound annual growth rate (CAGR), you need a stock portfolio of $100,000 to receive that level of passive income.

Is 12% realistic? I think it is.

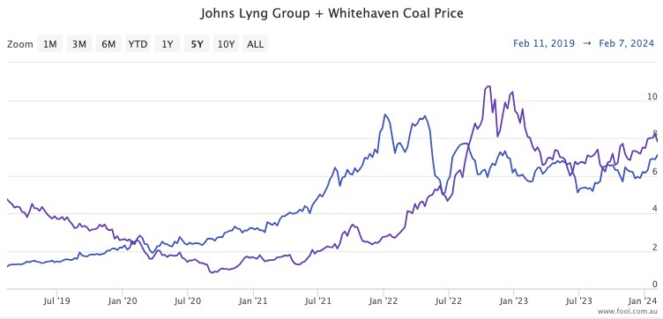

Check out popular ASX growth stocks like Johns Lyng Group Ltd (ASX: JLG) or Xero Ltd (ASX: XRO).

Over the past five years, through such trauma as the COVID-19 crash and the inflation selloff, they have returned 480% and 130% respectively.

That equates to a CAGR of 42% and 18%.

Even looking at dividend stocks, if you had the foresight to own Whitehaven Coal Ltd (ASX: WHC) over the past half-decade, you would have gained almost 70% while raking in a yield of 9.7%.

I'm not suggesting you will consistently pick spectacular winners like Johns Lyng, Xero and Whitehaven.

If you did, you would be some sort of stock-picking savant who would be working for an investment bank.

No, the point is that if you have some such winners, they can absorb the losses from your flops and then some.

It's all about diversification.

The short answer and the long answer

That's the short answer — $100,000 is how much you need to produce $1,000 of monthly passive income.

But what if you don't have that sort of cash just laying around?

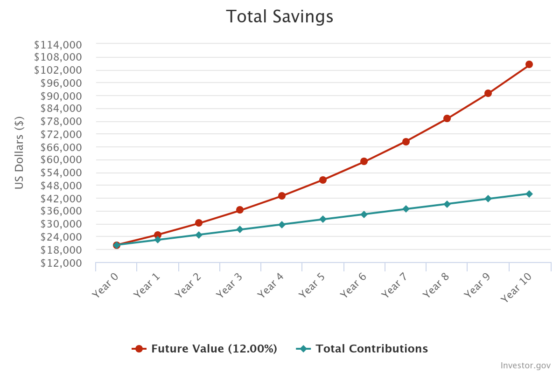

If you just have $20,000 to invest, but you can afford to chip in an extra $200 each month, the power of compounding will take you to the promised land in 10 years.

From then on it's all gravy as you rake in a grand every month for doing nothing.

Sweet as.