Nothing demonstrates the warning that "past performance is not an indicator of the future" better than watching former market darlings crash and burn.

A prime example from the S&P/ASX 200 Index (ASX: XJO) in recent times is Domino's Pizza Enterprises Ltd (ASX: DMP).

The stock made many Australians wealthy in the 2010s and even during the early years of the pandemic.

But it has been a sorry tale the past couple of years.

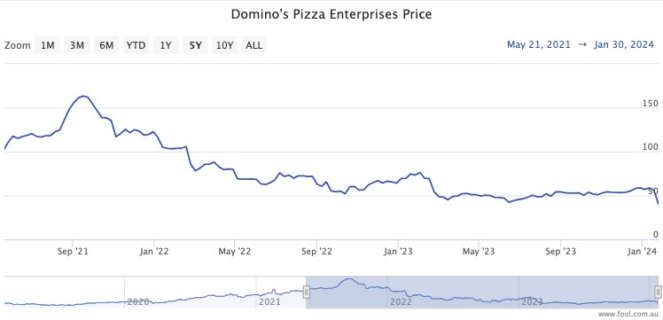

The Domino's share price, if you can believe it, has tumbled 75% from its high in September 2021.

Just last week investors ran from the stock like it was a burning building, sending it 31% down in a single day.

Good God, that's some heavy discounting.

So, quite rightly, some investors are now asking whether Domino's shares have capitulated.

Is it time to pick up the bargain of the century?

What the heck happened last week?

Firstly, let's take a look at what precipitated last Thursday's disastrous fall.

It seems a business update that day sent the market into a frenzy.

"Domino's preliminary net profit before tax is expected to be between $87 million and $90 million," reported The Motley Fool's James Mickleboro.

"It is still well short of the consensus estimate of $103 million, which explains why Domino's shares are taking a beating this morning."

Within days, both Goldman Sachs Group Inc (NYSE: GS) and Macquarie Group Ltd (ASX: MQG) downgraded their share price expectations for the pizza chain.

Do the professionals think Domino's share price is low enough to buy?

And unfortunately that probably reflects the sentiment of the professional community at large about Domino's prospects.

CMC Invest shows only five out of 16 analysts rate the stock as a buy at the moment.

Although the finance industry is notorious for its reluctance to put out sell ratings, seven analysts have gone down that route.

That's a damning assessment for a company that used to be a staple in many portfolios.

So, at this stage, Domino's is not exactly a no-brainer buy.

That's not to say you can't make money out of it in the long run, but there are enough risks still that committing now would take a significant leap of faith.