At The Motley Fool, we're all about long-term investing.

However, it's fun to see how certain stocks rocket overnight from time to time.

It demonstrates how a massive winner can carry your portfolio, even if your other stocks are growing at a pedestrian rate.

Pocketing $5,800 in just one month

Take Boss Energy Ltd (ASX: BOE), for example.

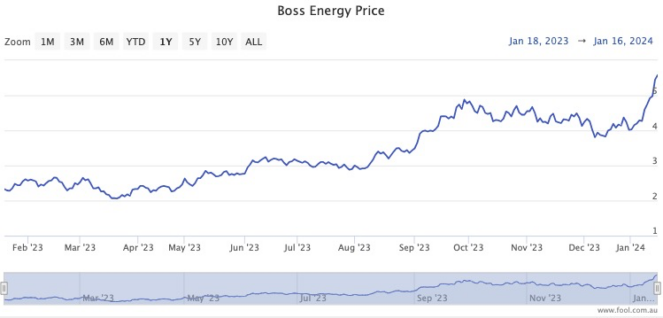

The uranium producer has ridden a boom in the nuclear fuel sector, with the stock price soaring more than 29% over the past month.

So if you bought $20,000 of Boss Energy shares a month ago, they would now be worth $25,800.

That's a $5,800 profit in just 31 days!

Over the past year, the Boss share price has gained an amazing 137%.

That's more than double in just 12 months.

Sure beats a term deposit.

Plenty more upside for Boss Energy shares

Many professional investors are bullish on uranium and ASX uranium shares at the moment.

A stunning announcement recently from the world's biggest miner of the nuclear fuel certainly helped.

Kazakhstan's National Atomic Company Kazatomprom Joint Stock Company (FRA: 0ZQ) last weekend downgraded its 2024 production forecasts because of a shortage in the supply of sulphuric acid.

Sulphuric acid is an essential ingredient in the processing of uranium.

Former earth sciences researcher and current analyst John Quakes said on X that the news was a rock thrown into waters of the global nuclear sector.

"And now we watch the ripples spread across the world.

"Every other producer, trader and nuclear utility affected by the 'potential' for missed deliveries will now be actively seeking out spot lbs to hedge against that possible outcome, which will then translate into far higher spot U3O8 prices as a bidding war erupts."

According to CMC Invest, five out of the six analysts that currently study Boss Energy shares rate them as a strong buy.