Regular readers already know the bull case for ASX uranium shares, but this thesis just received a massive boost, sending stock prices rocketing on Monday.

The world's largest uranium miner, National Atomic Company Kazatomprom Joint Stock Company (FRA: 0ZQ), announced over the weekend that its 2024 production forecasts have been downgraded due to short supply of sulphuric acid.

The acid is used in the mining process for uranium.

This news out of Kazakhstan has sent the uranium market and uranium stocks into a frenzy.

Betashares Global Uranium ETF (ASX: URNM), as an example, has risen 6.7% at the time of writing on Monday afternoon.

Ironically, Kazatomprom shares also surged 7.3% higher on Saturday Australian time.

ASX uranium shares going gangbusters on Monday

Other ASX uranium shares are making hay too. As at the time of writing on Monday afternoon:

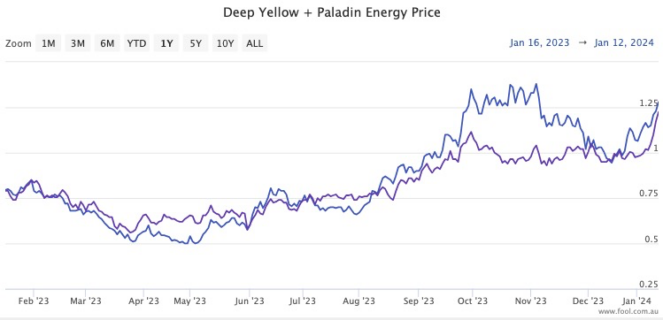

- Paladin Energy Ltd (ASX: PDN) is up 9.5%

- Boss Energy Ltd (ASX: BOE) is up 6.9%

- Deep Yellow Limited (ASX: DYL) is up 14.6%

- Bannerman Energy Ltd (ASX: BMN) is up 9.5%

"Kazatomprom has heaved a rock into the global nuclear fuel industry waters and now we watch the ripples spread across the world," said former earth sciences researcher and current analyst John Quakes on X.

"Every other producer, trader and nuclear utility affected by the 'potential' for missed deliveries will now be actively seeking out spot lbs to hedge against that possible outcome, which will then translate into far higher spot U3O8 prices as a bidding war erupts."

Caldera House principal Gigi Penna was also amazed at the development.

"There ain't no bull market like a uranium bull market," Penna said on X.

"If Cameco Corp (NYSE: CCJ) cuts too it could get crazy."

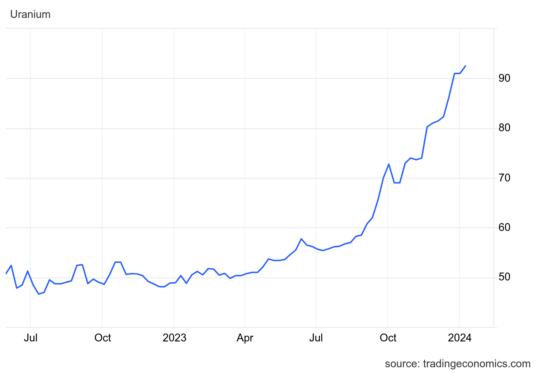

The uranium price rocketed last year after Russia's invasion of Ukraine forced many countries to reconsider nuclear as a source of low-emissions energy.

The war also incentivised existing nuclear users into boycotting Russian uranium exports.

The price for the fuel went from around US$50 per pound at the start of 2023 to now almost double that.