As investors in ASX shares return to their desks after the holidays, there are plenty of global developments to keep an eye on.

eToro market analyst Josh Gilbert has summarised the three most important ones to look out for this week:

1. Australia inflation

The monthly consumer price index was released last week, but Tuesday will see the latest Melbourne Institute's inflation expectations and the Westpac Banking Corp (ASX: WBC) consumer confidence reports.

With inflation seemingly cooling, financial markets are now pricing in an interest rate cut by August, according to Gilbert.

"That may come sooner if economic data continues to move in the right direction," he said.

"The first RBA monetary policy meeting of the year commences at the start of February, where the board is largely expected to keep rates on hold, and that would more than likely mean the peak in interest rates."

2. Australia unemployment

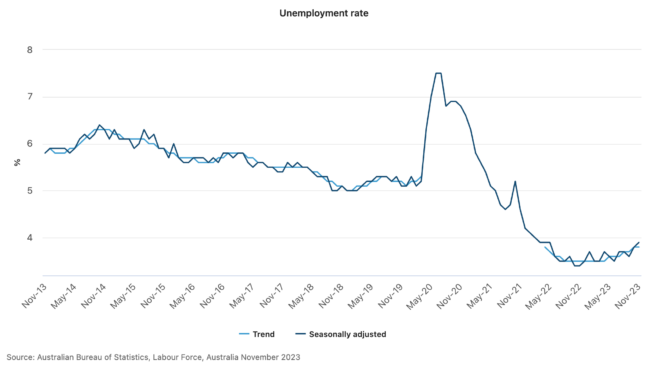

The latest labour force data will be released on Thursday, and it's probably the second most critical metric that the Reserve Bank will watch to make its February decision.

Gilbert reminded that the last report, for November, saw unemployment rise to a seasonally adjusted 3.9%.

"Bad news to anyone on the job hunt but good news for those hoping for a cooling economy."

This time he is tipping "a small rise" in the jobless queue, with most employers unlikely to have taken on new staff during the holiday season.

"If the figure slips above 3.9% to 4% or higher, we will be well and truly on track to reach the [federal] treasurer's 'sustainable unemployment' target of 4.5%.

"While some economists believe it's unnecessary for the rate to climb that high for the economy to recover, anything above 4.25% will give the RBA the confidence it needs to consider cutting rates sooner."

3. Bitcoin's giant step

Last week's historic approval in the United States of Bitcoin (CRYPTO: BTC) spot ETFs will trigger much scrutiny on the cryptocurrency's price in the coming days.

Gilbert predicts "a strong year" with "many catalysts" for the digital asset.

"Whatever time horizon you look at, risk-adjusted returns for bitcoin are dramatically higher than any other asset class and the ETF may be the option investors choose to take on."

The development also brings closer the idea of a digital Australian dollar.

"With the RBA continuing active research into a CBDC this year, the ongoing legitimisation of crypto as an asset class bodes well for those hoping financial institutions continue to embrace the technology."