Of course, the way an S&P/ASX 200 Index (ASX: XJO) business conducts itself is the major factor in how attractive shares are to investors.

But if the demand for their products and services are inflated by unstoppable consumer trends, then it makes the job so much easier for all concerned.

Let's check out two such stocks that experts have nominated as buys for the new year:

'Resilient' growth forecast for this ASX 200 company

Sleep apnoea device maker Resmed CDI (ASX: RMD) must be a contender for the most-discussed ASX stock of 2023.

During the August reporting season the share price took an unfortunate dive after the market was spooked by the potential impact of new GLP-1 weight loss drugs on obesity.

Excessive weight is one of the big contributing factors to sleep respiratory issues.

Between 2 August and 25 September, ResMed shares plunged 37%.

Shaw and Partners senior investment advisor Jed Richards reckons, honestly, there's nothing to see here and that the diet drug fear is overdone.

"Several structural themes continue to support ResMed's growth in the medium to longer term, such as an ageing global population and an increasing awareness of sleep apnoea," Richards told The Bull.

"Government regulation expanding the use of digital health applications provide[s] a compelling backdrop for ResMed to continue growing resiliently."

Indeed, many of his peers agree.

According to CMC Invest, a whopping 18 out of 24 analysts currently believe ResMed shares are a buy.

'One of the best placed Australian companies'

Over the past two years there has undoubtedly been a shift in the way the world thinks about energy production.

Russia's invasion of Ukraine really struck fear into many countries about their energy security, forcing them to think about reducing their dependence on the import of fossil fuels.

This has brought nuclear power back in a favourable light, after it was largely shunned about a decade ago after the Fukushima disaster in Japan.

Through the 2010s the uranium price had been so stagnant that many mines halted production because it was not worth the effort.

Now they're being reactivated as the world turns to a method of power generation that can produce an abundance of energy for little carbon emissions.

Fairmont Equities boss Michael Gable is expecting the demand for uranium to well exceed supply in 2024 and beyond.

"This imbalance comes at a time when major economies are committing to increasing their nuclear energy capabilities in order to meet net zero targets," he said.

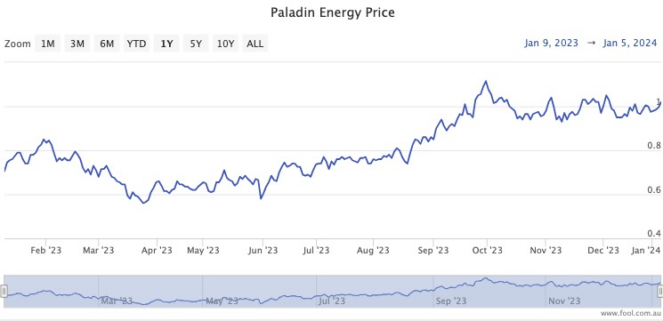

"Uranium prices have increased more than 60% in calendar year 2023 up to December 21, and I expect this upward trend to continue in 2024."

Out of ASX-listed miners, he is a fan of Paladin Energy Ltd (ASX: PDN).

The company's big asset is the Langer Heinrich mine in Namibia, which is scheduled to resume production within the next three months.

"Paladin is one of the best placed Australian companies poised to benefit from increasing uranium prices during the next 12 months."