Sometimes it's worth taking a look at ASX shares that are not household names.

After all, every other investor is also well acquainted with all those names that are familiar to you, so there are really no secrets or bargains.

But those more obscure businesses that are not often discussed could be going for cheap with plenty of future potential.

Medallion Financial Group advisor Stuart Bromley recently named two such ASX shares that are his picks for 2024:

Appealing for customers seeking 'the best available solution'

Biotech stock Polynovo Ltd (ASX: PNV) is down more than 31.5% over the past 12 months, but the burns recovery solutions provider is on the cusp of exiting the pre-revenue phase.

"PolyNovo's innovative products are competitively priced and are often significantly cheaper than competitors in major markets," Bromley told The Bull.

"Consequently, the company's products and pricing power appeals to hospitals searching for the best available solution."

Polynovo's $66.5 million revenue in the 2023 financial year was up almost 60%, which is appealing for Bromley.

"The company continues to expand geographically, which generates new revenue streams."

The income is invested back into the business for its future pipeline, giving investors excellent hope for growth.

"The company's investment in products and staff should reward investors moving forward," said Bromley.

"In our view, the company offers a bright outlook in fiscal year 2024 and beyond."

Selling consumables to famous clients

XRF Scientific Limited (ASX: XRF) is a $160 million small-cap that makes products for testing mineral samples.

Bromley loves its long list of big-name customers.

"XRF's blue-chip clients highlight the quality of its offering, with the company servicing Rio Tinto Ltd (ASX: RIO), BHP Group Ltd (ASX: BHP), Vale SA (NYSE: VALE), South32 Ltd (ASX: S32), Glencore PLC (LON: GLEN) and Alcoa Corp (NYSE: AA), among others."

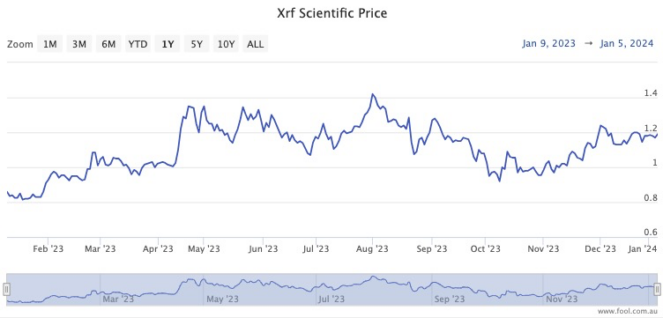

After an up-and-down 12 months, the XRF share price is now trading more than 35% higher.

Sales revenue, net profit and operating cash flow were all up substantially in the 2023 financial year.

Bromley tells investors to not be fooled by XRF Scientific's small size, as the business is "fundamentally strong".

"We're optimistic given the company generated revenue of $13.6 million in the 2023 September quarter, up 8% on the prior corresponding period.

"The company generated $5.1 million in capital equipment product sales, up from $4 million in the prior corresponding period."

And there is a huge ace up the sleeve for those willing to invest for the long run.

"We expect the forward-looking investor will also benefit from higher margin recurring revenues anticipated to flow through from the consumables side of the business, in the form of chemicals and labware required for ongoing sample analysis."