If you fancy $1,000 of cash each month for no work, then you've come to the right place.

Because that's a very achievable goal using the magic of ASX shares and compounding.

And it doesn't take much investment to get to that level of passive income.

Let me show you a hypothetical:

Can you spare $400 a month for 7 years?

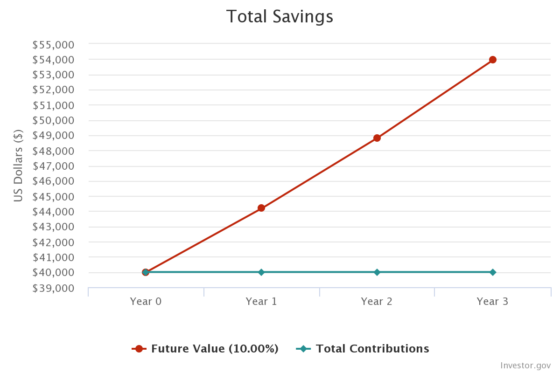

If you start with $40,000, which is what comparison site Finder found was the average amount of savings that each Australian has, then $1,000 of monthly income is not far away.

In fact, if you can construct a portfolio that can produce 10% compound annual growth rate (CAGR) and add $400 to it each month, you will have reached the destination in just seven years.

That's because, after monthly compounding, your investment will have grown to $128,696.

From that point on, if you cash in the 10% gain each year, you will receive annual passive income of $12,869.

And how much is that each month?

$1,072.

Can the portfolio really grow that fast?

But you might rightly ask, is 10% CAGR realistic?

I put it to you that it is, if you do your research and listen to advice about picking quality stocks.

Check this out.

While the past never dictates what future performance could be like, looking back at how some current favourites have done gives a clue as to whether 10% is achievable.

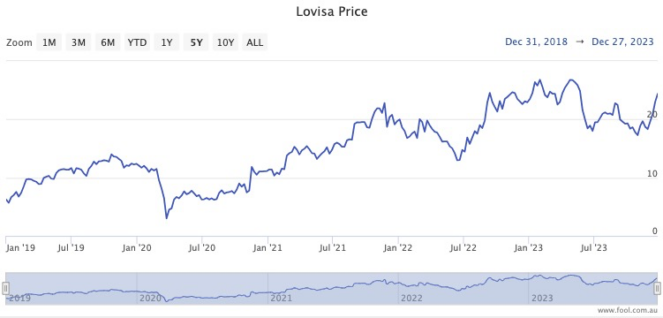

Lovisa Holdings Ltd (ASX: LOV) is currently rated a buy by nine out of 12 analysts surveyed on CMC Invest.

Over the last five years, the Lovisa share price has climbed 332%. That's a CAGR of 34%.

As the dominant real estate classified site in the country, Rea Group Ltd (ASX: REA) is a staple in many Australian portfolios.

The past half-decade has seen its stock price gain 150%, which equates to a CAGR of more than 20%.

Even a cyclical dividend stock like BHP Group Ltd (ASX: BHP) is now trading 51% higher than it did at the start of 2019.

That gives it a CAGR of 8.59%. If you add in the 5.2% fully franked dividend yield, the annual returns are easily into double digits.

Of course, not every stock you pick will end up performing as well as these examples.

But if you have a well diversified portfolio then these beauties mixed with some duds could average out to 10% CAGR.