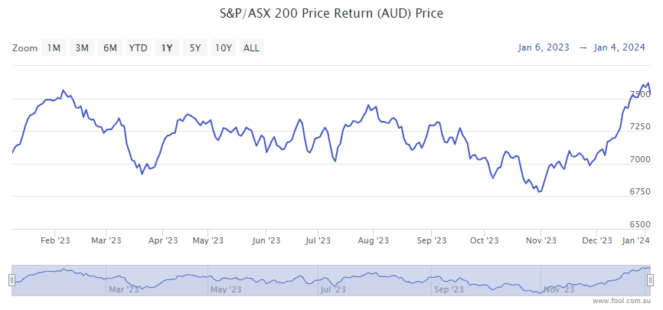

S&P/ASX 200 Index (ASX: XJO) stocks are in the red during the first week of trading for 2024, down by 1.2% since Tuesday to 7,498.9 points.

This follows an 8.1% gain for the index in 2023, in large part due to a strong Santa Rally, as shown below.

As we reported earlier this week, several ASX 200 stocks are starting the year on 52-week highs.

Here are three at the other end of the spectrum, starting the new year at or near 52-week lows.

Treasury Wine Estates Ltd (ASX: TWE)

The Treasury Wine share price is $10.36, up 0.2% at the time of writing on Friday. The ASX 200 wine share is trading not far off its 52-week low of $10.19, which it recorded on 28 November 2023. Over the past 12 months, Treasury shares have fallen 22%. But 2024 could be a better year, especially if China drops its tariffs on Australian wine, as expected, in February or March. Morgans has an add rating and a $14.15 price target on the ASX 200 stock, implying a potential 37% upside in the new year.

Iluka Resources Limited (ASX: ILU)

The Iluka Resources share price is $6.41, up 1.2% on Friday. The ASX 200 mining share hit a new 52-week low of $6.31 yesterday. Over the past 12 months, Iluka shares have fallen by 35%. Goldman Sachs says Iluka's sales volumes should improve in the new year. The broker says the ASX 200 mining stock is a buy, partly due to its attractive valuation at 0.57 times of net asset value (NAV). It has a price target of $10.80 on Iluka shares, indicating a potential near-70% upside in 2024.

Nickel Industries Ltd (ASX: NIC)

The Nickel Industries share price is 67 cents, down 2.2% on Friday. The ASX 200 nickel share is just off its 52-week low of 66 cents, which it recorded on 13 December. Over the past 12 months, Nickel Industries shares have fallen by 35%. Nickel futures are close to a three-year low at US$15,835 per tonne. According to Trading Economics analysis, this is due to reduced demand due to weaker economic conditions globally and robust supply from the world's leading nickel producers, Indonesia, the Philippines and China. The consensus rating on this ASX 200 stock, published on CommSec today, is a strong buy.