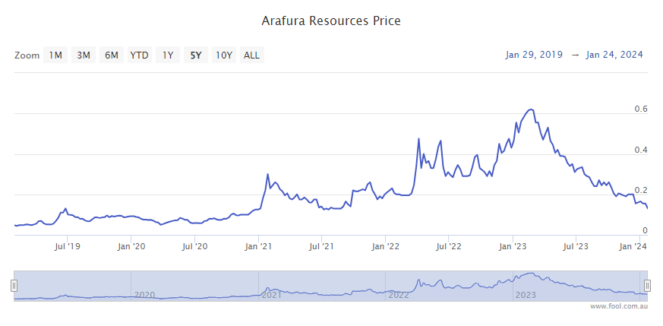

The Arafura Resources Limited (ASX: ARU) share price reset its 52-week low on Thursday at 12 cents after the ASX rare earths developer released its December quarterly activities report.

However, Arafura shares later recovered and closed the session up 4% at 13 cents. The ASX rare earths share has lost 77% of its value over the past 12 months.

Arafura owns the Nolans Neodymium-Praseodymium (NdPr) Project in the Northern Territory. NdPr is used in electric vehicles (EVs).

Let's review the report.

Arafura share price hits new 52-week low

Let's cover some of the numbers from the report first.

Over the three months to 31 December 2023:

- $800,000 spent on exploration and evaluation activities

- $2.7 million spent on corporate, administration, and business development

- $22.8 million spent on project development activities

- Average monthly cash expenditure decreased over the quarter to $8.7 million

- Cash reserves of $67 million as of 31 December, including institutional placement proceeds

- Arafura declared it has 2.5 quarters of funding left.

What else happened during the quarter?

Arafura completed early construction work at Nolans during the quarter. It now has an operations program underway to prepare the site for main construction once final project funding is sorted out.

The company expects to finalise funding in the first quarter of 2024. It says there are currently no material changes to capital cost estimates for the Nolans Project.

Arafura is seeking to fund Nolans via offtake agreements, debt funding and an institutional and retail capital raise.

Last month, Arafura received a letter of interest (LoI) from Korea EXIMbank (KEXIM), otherwise known as the Export–Import Bank of Korea and the official export credit agency of South Korea. KEXIM indicated an offer of up to US$150 million of debt funding via direct lending and an untied loan guarantee.

The LoI is linked to binding offtake arrangements with Hyundai Motor Corporation and Kia Corporation. South Korea wants to secure NdPr supply to help in the electrification of its car manufacturing sector.

Arafura said all contracted offtake groups are now strategically linked to international export credit agency support via non-binding Lols or similar.

$10 million share purchase plan fails to reach target

Today, Arafura also announced the results of its share purchase plan (SPP), which closed on Monday.

The SPP provided eligible shareholders the opportunity to apply for up to $30,000 worth of new Arafura shares at 16 cents per share. At the time Arafura announced the capital raise, this was a 20% discount.

Arafura was hoping to raise $10 million but received $6.5 million (before costs) from 710 applications.

The SPP follows a fully underwritten institutional placement in December, which targeted $20 million but was upsized to $25 million due to "strong demand from leading investor groups", the company said.

Arafura share price snapshot

The Arafura share price has fallen 77% over the past year.

By comparison, the S&P/ASX All Ordinaries Index (ASX: XAO) has increased by 0.98%.