The leading investors from Wilson Asset Management (WAM) have shared thoughts on two very interesting ASX growth shares.

Both of these stocks are S&P/ASX 300 Index (ASX: XKO) shares which have already delivered a lot of long-term growth.

WAM recently talked about two of the most compelling businesses in its portfolio which are growing. Let's find out about those stocks.

Collins Foods Ltd (ASX: CKF)

The fund manager described Collins Foods as a KFC and Taco Bell restaurant operator and franchisee in Australia and Europe.

WAM noted in November, the company reported a strong FY24 half-year performance, revealing a 28.7% year over year increase in underlying net profit after tax (NPAT) from continuing operations to $31.2 million which was "considerably ahead" of market expectations, "triggering earnings upgrades."

Collins Foods has exited a challenging period with the brand's "success in passing on price increases to its customers to offset inflationary pressures, reflecting on the resiliency of the business category and brand strength."

The ASX growth share has reduced its net debt and, with the strength of its brands, WAM said the company is "well-positioned to weather economic challenges whilst generating organic growth via store roll-out and margin expansion."

WAM suggested acquisition activity remains a "key potential catalyst both within existing and new regions in Europe."

Since the start of 2023, the Collins Foods share price has risen 67%.

Temple & Webster Group Ltd (ASX: TPW)

This business is described as a leading online retailer of furniture and homewares.

At the recent annual general meeting (AGM), the ASX growth share provided a "solid" trading update to shareholders.

Sales from 1 July to 27 November 2023 were up 23% compared to the prior period and revenue was up 42% year over year during 1 October to 27 November. Temple & Webster achieved $17.4 million of sales between Black Friday to Cyber Monday, which was up 101% year over year.

WAM believes Temple & Webster's balance sheet is in a "strong financial position, providing opportunities to undertake accretive acquisitions or capital management."

The fund manager thinks the ASX growth share remains "well-positioned to drive ongoing market share gains and accelerate sales growth."

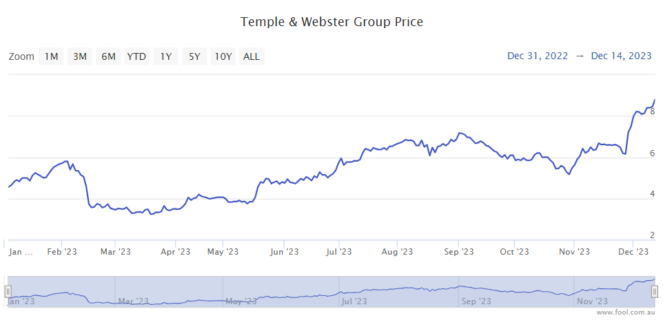

Since the start of 2023, the Temple & Webster share price has almost doubled.