Catching positive momentum early can be rewarding for S&P/ASX 200 Index (ASX: XJO) investors.

Not only does it mean you're buying the shares at a reasonably low price, your wealth can increase over the long run from those who are catching onto the story later than you.

Here are two such ASX 200 stocks that Fairmont Equities managing director Michael Gable considers a buy right now:

'We expect the shares to recover'

The story behind Resmed CDI (ASX: RMD) shares has been well documented this year.

For those catching up, the rise of the new GLP-1 weight loss drugs like Ozempic has put a fright into many investors. They're concerned that a reduction in obesity will mean fewer opportunities for a sleep apnoea device maker like ResMed.

The ASX 200 stock is thus down 26.5% since early August, but it's had a 15.5% revival over the past seven weeks.

Gable told The Bull that this rally could rapidly gain momentum.

"We expect the shares to recover, fuelled by short covering," he said.

"ResMed revenue rose 16% in the first quarter of fiscal year 2024 compared to the prior corresponding period."

It seems Gable is not the only one thinking along these lines.

CMC Invest is currently showing 18 out of 24 analysts rating ResMed as a buy.

'A higher share price moving forward'

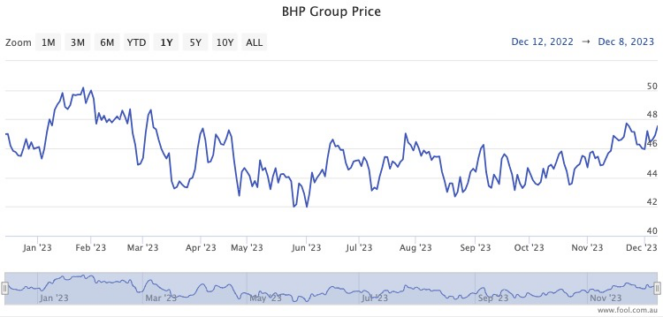

The weak global economy this year has not helped a commodity producer like BHP Group Ltd (ASX: BHP).

The mining shares are down 4.5% since mid-January as demand for resources has stalled both in western countries and China.

However, similar to ResMed, recent weeks have shown hints of a turnaround, with a 10% rally since 20 October.

"The global miner's share price has been gaining momentum," said Gable.

"The recent break-out points to a higher share price moving forward."

He added that his team has a "bullish view on resources", and BHP specifically.

"Copper production increased by 11% in the first quarter of fiscal year 2024 when compared to the prior corresponding period," he said.

"Production guidance in fiscal year 2024 remains unchanged."