Small-cap stock investors have watched in horror the past couple of years as their holdings kept shrinking.

However, it seems multiple experts are tipping a turnaround in 2024.

The team at LSN Emerging Companies Fund is one of those groups that reckon the stage is set for a small-cap comeback.

"November showed the early signs of a recovery in global small caps, with Small Industrials (+8.6%) materially outperforming ASX Top 20 (+4.0%), as the underlying investment fundamentals on offer start to become the focus," it stated in a memo to clients.

"This has continued into December with small caps stocks starting to unwind the significant underperformance relative to larger cap stocks over the last two years."

This potential is triggered by the prospect of an ease in interest rate pressures.

"With the recent downside surprise in both US and domestic inflation, markets are now pricing multiple interest rate cuts in 2024, which is a far more attractive backdrop."

The analysts named two small-cap ASX shares specifically they are bullish on:

'Strong demand' and 'limited new supply'

MMA Offshore Ltd (ASX: MRM) is not often discussed, but its share price has gained an incredible 69.5% this year.

The LSN team has done pretty well out of the company already but continues to have a bullish outlook.

"Offshore service vessel operator MMA Offshore has been a core holding in the portfolio since early 2022," read the memo.

"At its AGM in November, [it] provided a trading update, where it indicated 1H24 EBITDA would be in the range of $55 million to $60 million, materially above expectations and 80-90% above 1H23, with all parts of the business… performing strongly."

The company provides ships and services to clients that have offshore oil rigs and the like.

And because its customers are booming, so is MMA Offshore.

"A combination of strong demand for offshore vessels and limited new supply of vessels in recent years is seeing day hire rates accelerate, driving strong profit growth."

MMA Offshore currently sits among LSN's five biggest holdings.

Believe it or not, all five analysts surveyed on CMC Invest currently think MMA Offshores shares are a strong buy.

'Significant driver of growth'

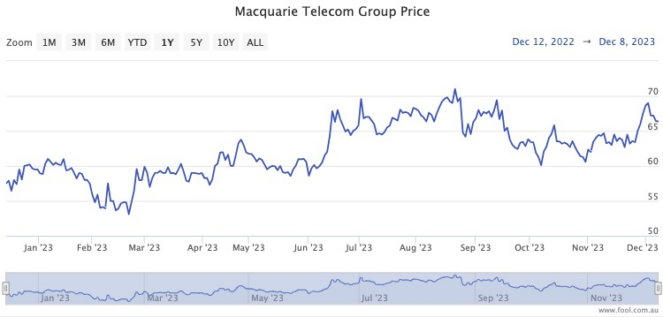

Data centres and telecommunications provider Macquarie Technology Group Ltd (ASX: MAQ) has seen its shares rally almost 24% off a February trough.

New clients are climbing aboard as the appetite for cloud computing expands by the day.

The analysts at LSN like the look of one particular contract signed recently.

"Macquarie Technology Group has been given approval from the NSW Department of Planning and Environment (DPE) for their data centre expansion (IC3 Super West), commenting that 'the development is in the public interest and should be approved, subject to conditions'.

"This project is the significant driver of growth for Macquarie Technology, given it will triple its current data centre capacity at [a] time of explosive demand for cloud services."