Every ASX business will go through tough times. No exceptions.

But the difference for long-term investors is whether it's just a temporary dip in fortunes or whether there is a more prolonged rot setting in.

If it's the former, there could be an argument to buy while the market is punishing the stock then wait for the storm clouds to blow away.

Take S&P/ASX 200 Index (ASX: XJO) stalwart Bapcor Ltd (ASX: BAP) as an example.

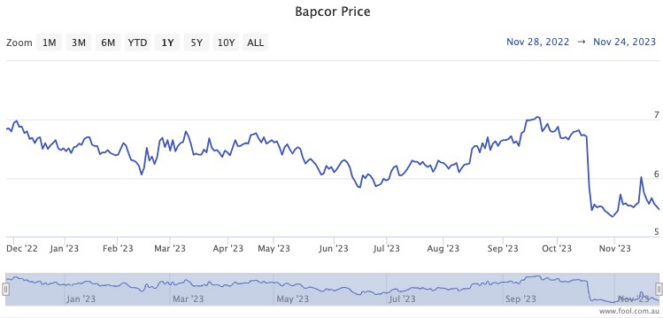

Investors have hammered the automotive parts business this year, with the stock trading more than 22% lower than it was 12 months ago.

However, Shaw and Partners portfolio manager James Gerrish and his Market Matters team are bullish on Bapcor.

Let's check out why:

The dip is 'more short term than structural'

Last month was especially disappointing for Bapcor investors, with the stock falling 22.5% since 12 October.

Gerrish told his Market Matters subscribers that the company's share price is now "hovering around its two-year low".

"The stock has struggled since disappointing the market in October by flagging a softer 1Q at the AGM.

"Costs have been the issue, as they have been across many companies and industries through 2023."

In the long run, Gerrish has faith that the ASX 200 business and stock will pick itself back up.

"We expect earnings to recover through 2024, as automotive repair work can only be put off for so long before things grind to a halt," he said.

"We see this stock as a turnaround story moving forward."

Gerrish's team already has a 3% position of Bapcor in its emerging companies portfolio, but is now considering adding to its investment.

Earlier this month, the analysts at LSN emerging companies fund also expressed their confidence that Bapcor would bounce back.

"Whilst the short-term headwinds are disappointing, we remain attracted to the business and believe the impact is more short term than structural, which, combined with significant efficiency improvement they are targeting, will see a return to solid profit growth in 2H FY24."