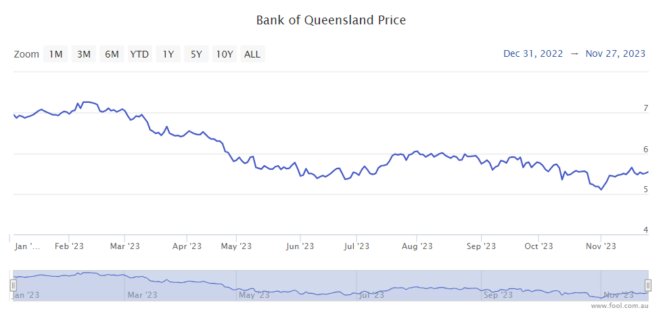

The Bank of Queensland Ltd (ASX: BOQ) share price is down close to 20% this year, though it has risen 6% in the last month as we can see on the chart below.

Last month, the company released its FY23 result which didn't have many positives. Cash earnings per share (EPS) fell 10% to 68.4 cents, statutory net profit after tax (NPAT) dropped 70% to $124 million, and the annual dividend per share fell 11% to 41 cents per share.

The net interest margin (NIM) fell 2 basis points to 1.69% because of competition. There was also housing loan contraction (rather than growth) of 1% and the loan impairment expense increased $58 million to $71 million.

So can the Bank of Queensland share price reach $6 by Christmas?

Investors should keep in mind that Christmas is only a month away, so focusing on a one-month investment timeframe is probably too short-term in my view.

Would a BOQ share price of $6 be reasonable?

The Bank of Queensland share price started the year above $7, so getting back to $6 wouldn't be preposterous.

According to projections on Commsec, the business is predicted to generate EPS of 47.8 cents. That would put the current BOQ share price at 11.5 times FY24's estimated earnings.

If the valuation were to reach $6, then the Bank of Queensland share price would be 12.5 times FY24's estimated earnings.

A price/earnings (P/E) ratio of more than 12 times may be reasonable if the bank were growing profit, but the current projection for FY25 shows a possible EPS of 46.7 cents. This implies profit could slightly reduce in FY25 – so profit would be going in the wrong direction!

Investors will usually value a company's earnings at a lower multiple if future years are expected to show profit declines.

Analysts are quite negative on the ASX bank share at the moment. According to ratings collated by Factset, there are currently seven sell ratings on the business, with two holds and just one buy.

In other words, numerous analysts think the BOQ share price is headed lower from here, not higher.

Can the Bank of Queensland share price reach $6 in the long term?

The ASX bank share may face difficulties in the short term and the broker UBS thinks BOQ is reliant on external factors to achieve its goals, which are at risk because of competition.

But, the broker notes the bank is planning to reduce its full-time employee equivalent by around 400 by FY26.

BOQ is also investing in technology and digital transformation, though this is increasing technology service costs.

The broker points out the bank is trading below its long-term price-to-book ratio and P/E ratio.

UBS rates Bank of Queensland as a sell because there are dangers of the bank failing to deliver on its digital transformation and cost reduction plans. There could also be "negative surprises on possible remediation costs" while the broker is also "mindful of the normalising credit cycle".