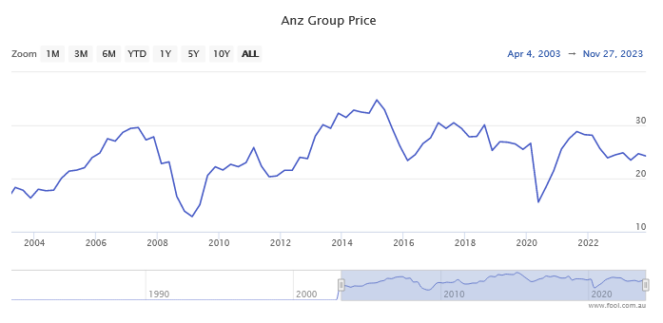

If you don't own ANZ Group Holdings Ltd (ASX: ANZ) stock, I'd encourage you to take a look at the ANZ stock price over the past 20 or so years below:

As anyone who has owned this ASX 200 big four bank stock for any meaningful period of time would probably be aware, this venerable bank hasn't really done much in the past 18 years. Today, at just over $24 a share, you can buy ANZ for pretty much the same price as you could have back in 2006.

Sure, ANZ has had its fair share of highs and lows over this large time span. Back in the depths of the global financial crisis in 2009, ANZ got down to under $13. And by mid-2015, we saw this bank's (still reigning) all-time high of over $36.

But still, investors who have held the stock for almost two decades have had nothing but the (albeit generous) ANZ dividend to show for their patience today

As such, it's probably not a controversial statement to say that ANZ stock has been stuck in a pretty deep multi-year rut.

So what would it take for ANZ to get out of its 18-year funk?

Can ANZ stock get out of its multi-year rut?

Well, that's hard to say. Part of the reason why the ANZ share price hasn't been budging is that investors are assigning it a low earnings multiple compared with the bank's Big Four peers. To illustrate, right now, the ANZ stock price is trading on a price-to-earnings (P/E) ratio of 10.72.

That is slightly below that of Westpac Banking Corp (ASX: WBC). Not to mention well under the multiples of 12.17 and 17.61 that National Australia Bank Ltd (ASX: NAB) and Commonwealth Bank of Australia (ASX: CBA) are trading on respectively.

To be sure, ANZ has had a tough few years. It has struggled with its mortgage offerings, which fell behind competitors due to comparatively long assessment periods. And it has failed to make any meaningful inroads into the business banking market that NAB dominates.

However, the bank's FY23 results arguably showed some promise. ANZ reported a 14% increase in cash from continuing operations, as well as a 10% hike to its annual dividend to $1.75 per share.

If ANZ can keep moving its numbers in the right direction over 2024, then there's a good chance that investors will take another look at its stock. Particularly if the bank can deliver another hefty dividend pay rise. Many investors buy ASX bank stocks like ANZ purely for the income potential.

At present, ANZ's 2023 dividend hike allows its shares to trade on a trailing yield of 7.23% today. If that were to rise even higher, it's very possible that more and more investors would start buying additional ANZ shares for income.

So those are the factors that I'll be watching next year. Let's wait and see what happens.