I discussed earlier this month how it took a while for Tesla Inc (NASDAQ: TSLA) to become a brand name synonymous with the entire electric vehicle industry.

Those investors courageous enough to buy split-adjusted US$1.13 shares at the initial public offering (IPO) in 2010 have now been handsomely rewarded.

A $10,000 purchase of Tesla stocks back then would now be worth an amazing $2.13 million.

The point of bringing up that journey is not to annoy you that you missed out on the sweet action. Rather it serves to highlight how backing outstanding businesses early on and persisting for the long term can produce incredible riches.

While no one knows what will happen in the future, there are ASX shares with the potential to execute Tesla-esque growth in the years to come.

Let's break down one such candidate:

Revenue up 9x, share price up 13x

Telix Pharmaceuticals Ltd (ASX: TLX) makes diagnostic and treatment products for cancer.

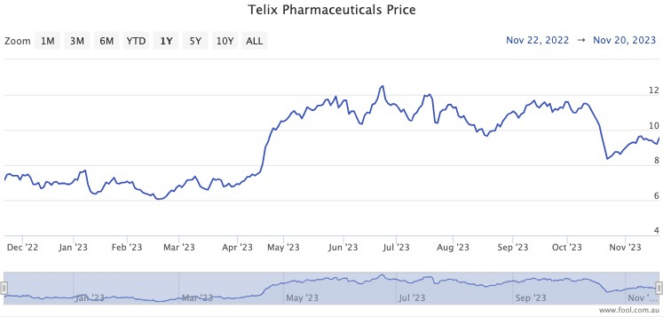

The last 18 months have been a whirlwind for the Melbourne business.

Its prostate cancer imaging agent Illuccix went commercial last year, while products for other forms of cancer are undergoing trials or approval stages.

Revenue was, incredibly, up nine-fold in the 2023 financial year compared to the year before. And despite having so many products still progressing through the pre-commercial stages, Telix was cash flow positive.

Therefore it may not surprise you that the Telix share price has already multiplied 13 times over the past five years.

That's a crazy compound annual growth rate (CAGR) of 67%.

How's the outlook for these ASX shares?

Despite the explosive growth already behind it, there are plenty of reasons to suggest Telix could keep going over the next few years.

The first is all that revenue growth came from just one product, Illuccix. The company has many others in development, to deal with cancers in different parts of the body.

Of course, there is no guarantee they will all make it out the other side of medical trials and regulatory approvals. But even if some of them can join Illuccix as a paying product in the coming years, Telix's investors will be very happy.

The other ace up Telix's sleeve is that it has the balance sheet to make acquisitions.

In fact, it has already started playing this card.

Just this week the business announced the acquisition of US outfit Qsam Biosciences, which is developing therapies for various types of cancer. At the start of this month, Telix completed the takeover of surgery technology provider Lightpoint Medical.

Many professional investors are believers in Telix.

According to CMC Markets, all seven analysts that cover the stock currently rate it as a buy.