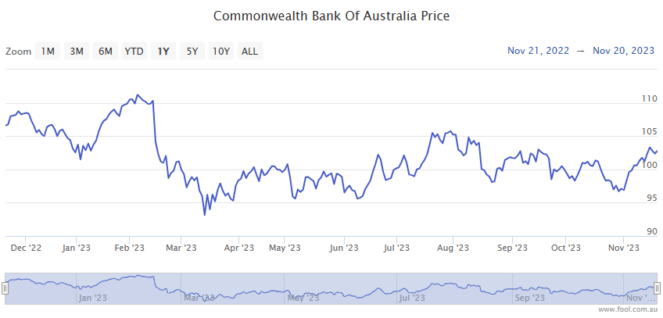

The Commonwealth Bank of Australia (ASX: CBA) share price has gained 3% so far in 2023.

And that's not including the $2.40 per share in fully franked final dividends the S&P/ASX 200 Index (ASX: XJO) bank stock paid out this calendar year.

But Australia's biggest bank faces some headwinds in 2024.

Can the CBA share price overcome these pressures and deliver gains again in the year ahead?

What's ahead for the CBA share price?

To gauge what could lie ahead for CommBank shares, we first look to the bank's latest quarterly results for the three months ending 30 September.

And those results were quite solid in a period of still high inflation and rising interest rates.

Among the highlights, which saw the CBA share price gain 1% on the day of reporting, the bank reported operating income of $6.82 billion, in line with the prior corresponding period.

While operating expenses increased by 3% to $3.04 billion, cash net profit was also up 1% to $2.5 billion.

And with 2024 likely to bring increased financial distress to some of CBA's business and retail clients amid ongoing elevated interest rates, it was pleasing to see the bank's Common Equity Tier 1 (CET1) ratio increase by 0.46% to 11.8%.

Still, this wasn't enough to convince some leading experts that the CBA share price will head higher in 2024.

According to the analysts at Goldman Sachs, despite the solid quarterly results, its shares still trade at an unjustifiable premium to its peers.

Commenting on the strong quarterly results, they said, "Even still, we don't think this justifies the extent of the valuation premium to peers".

They added:

While CBA has historically done a good job in balancing investment and productivity, we do not think it can escape elevated FY24 estimated cost pressures given heightened inflation; we reiterate our sell recommendation.

Goldman Sachs has a $81.64 target for the CBA share price, more than 21% below the current price.

Jabin Hallihan, investment adviser at Morgans, also has a sell rating on the ASX 200 bank stock. And for similar valuation reasons.

Commenting on the outlook for the big bank's shares a few days before CBA released its latest quarterly results on 14 November, Hallihan said (courtesy of The Bull):

CBA appears relatively expensive on investment metrics compared to the ANZ Bank and Westpac. The company's capital position remains strong, but the outlook suggests caution in this higher interest rate environment as borrowers struggle to meet rising mortgage repayments.

Indeed, at the current CBA share price the stock trades at a price-to-earnings (P/E) ratio of 7.4 times.

That compares to a P/E ratio of 12.1 times for National Australia Bank Ltd (ASX: NAB), 10.8 times for Westpac Banking Corp (ASX: WBC), and 10.6 times for ANZ Group Holdings Ltd (ASX: ANZ).

Not everyone is worried about that elevated valuation, though.

John Storey, the head of Australian bank research at UBS, said the bank's quarterly results were a "good story for income investors".

According to Storey (quoted by The Australian Financial Review), "We like CBA quite a lot, and it's a very non-consensus view. But we think they have a lot more levers to pull on to sustain their dividend at these types of levels."