We could all use some good news right now. And what better tale to tell in these tough economic times than a story of optimism, confidence, growth and — hopefully — future success!

It's widely considered that quality companies are well-placed to withstand economic downturns and even come through them stronger than ever.

So, to help you distinguish the discounts from the duds and possibly bag yourself 'the next big thing', we asked our Motley Fool writers which ASX shares they reckon are destined for the hallowed halls of the S&P/ASX 200 Index (ASX: XJO). Here is what the team came up with:

5 stocks that could be future ASX 200 constituents

- Temple & Webster Group Ltd (ASX: TPW), $805.32 million

- PWR Holdings Ltd (ASX: PWH) $1.03 billion

- Aussie Broadband Ltd (ASX: ABB), $1.08 billion

- Azure Minerals Ltd (ASX: AZS), $1.86 billion

- Yancoal Australia Ltd (ASX: YAL), $6.39 billion

(Market capitalisations as of 17 November 2023).

Why our Foolish writers have such faith in these ASX shares

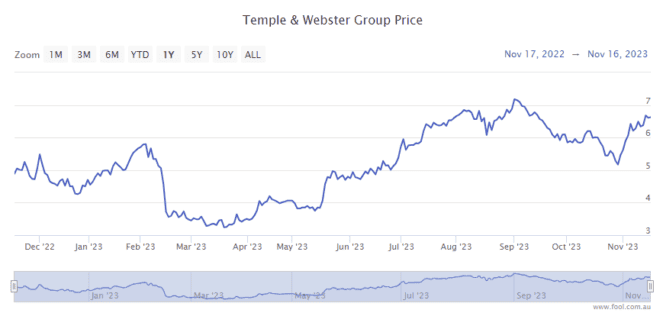

Temple & Webster Group Ltd

What it does: Temple & Webster sells hundreds of thousands of products across furniture and homeware categories from its e-commerce platform. The ASX retailer sells a large majority of products directly from suppliers, reducing the need for inventory and enabling it to operate with a capital-light model.

By Tristan Harrison: Temple & Webster wants to be the biggest retailer of furniture and homewares in Australia, which speaks of its ambitions. I think it can get there – revenue continues to grow strongly after the COVID e-commerce boom. In the first month and a half of FY24, we saw revenue growth of 16% year-over-year.

Management expects significant margin improvements in the longer term thanks to scale benefits, greater use of technology within the business, and AI to provide better customer service.

Pleasingly, the ASX share is expanding in areas like home improvement products and serving commercial customers. This gives the company a bigger growth runway.

With market capitalisation already around $800 million, I believe Temple & Webster has many years of growth ahead.

Motley Fool contributor Tristan Harrison owns shares of Temple & Webster Group Ltd.

PWR Holdings Ltd

What it does: PWR Holdings designs and manufactures high-performance cooling solutions for customers across defence, motorsports, automotive makers, and aftermarket applications.

By Mitchell Lawler: Speak to anyone serious about car performance, and you'll probably hear PWR getting thrown around. Plenty of motorheads consider the quality and reliability of PWR's various cooling solutions second to none – making its products sought after despite the typically premium price.

In my opinion, there's a lot to like about PWR Holdings. High gross margins, founder-led, track record of growth, and a clear technological competitive advantage. These ingredients are why I think this company can go from the ASX 300 to the ASX 200 index over time.

Promisingly, PWR Holdings recently entered into a new lease for a manufacturing facility nearly twice the size of its existing operations. I consider this a fair indication management is confident in expanding in the years to come.

Motley Fool contributor Mitchell Lawler does not own shares of PWR Holdings Ltd.

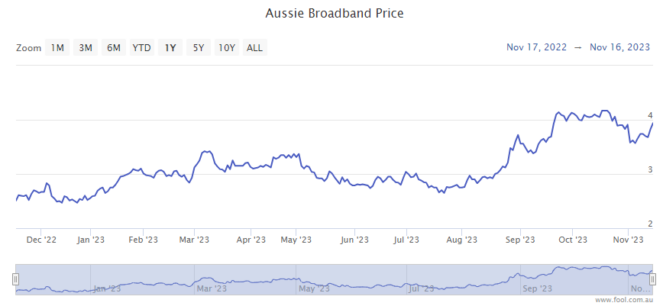

Aussie Broadband Ltd

What it does: Aussie Broadband is a fledgling, but fast-growing ASX telco, offering a range of telecommunication services to Australian customers.

By Sebastian Bowen: I think it's almost certain that Aussie Broadband will eventually see the other side of the ASX 200. Why? Well, because this impressive business can't seem to stop growing.

Its most recent full-year results (covering FY23) revealed that Aussie Broadband had managed to add another 18.2% to its total connections.

This in turn enabled the company to grow its revenues by 23.1% and its profits by more than 1,500% to $21.7 million.

This company is clearly doing something right. Customers seem to respond well to its focus on service and satisfaction. As such, I believe Aussie Broadband is ASX 200 bound, and sooner rather than later.

Motley Fool contributor Sebastian Bowen does not own shares of Aussie Broadband Ltd.

Azure Minerals Ltd

What it does: Azure Minerals is a lithium explorer in the Pilbara region of Western Australia.

By James Mickleboro: Based on recent drilling results, Azure Minerals' 60% owned Andover Project appears to be sitting atop a world-class lithium resource in a tier-one mining jurisdiction.

And given how demand for lithium is expected to grow materially over the long term thanks to the decarbonisation megatrend, this project could become a real cash cow.

I believe this makes an ascension to the ASX 200 index very likely in the future.

Motley Fool contributor James Mickleboro does not own shares of Azure Minerals Ltd.

Yancoal Australia Ltd

What it does: Yancoal is a coal miner with a range of high-quality coal assets across New South Wales, Queensland, and Western Australia. The company has a diversified mix of metallurgical and thermal coal mines.

By Bernd Struben: Yancoal Australia has proven to be a cash machine in a world with strong, ongoing medium-term demand for quality thermal and coking coal.

The miner has drawn increasing investor interest with its market-smashing dividend payouts. At the most recent share price, Yancoal trades at an eye-watering dividend yield of 22.1%.

While coal prices have come off the boil since last year, Yancoal is maintaining its strong balance sheet, in part by increasing production every quarter this year. As at 30 September, Yancoal was debt-free with a cash balance of $920 million. And that's after the miner paid out its $489 million interim dividend.

The Yancoal share price is down 3% over the past 12 months but up 85% in two years. This gives the miner a market cap of $6.4 billion, which already exceeds the valuation of many stocks presently included in the ASX 200.

Motley Fool contributor Bernd Struben does not own shares of Yancoal Australia Ltd.