There is much uncertainty about the global economy at the moment.

But whether the world is battling inflation, unemployment, lack of growth, or too much growth, there are some businesses that sell goods or services that people just can't do without.

Here are two such ASX dividend shares that the team at Celeste Funds is backing:

'Demographic tailwinds will support organic growth'

Guess what — everyone dies.

People pass away regardless of economic conditions, so one could argue the funeral industry is the ultimate resilient business model.

And Australia's population is rapidly ageing.

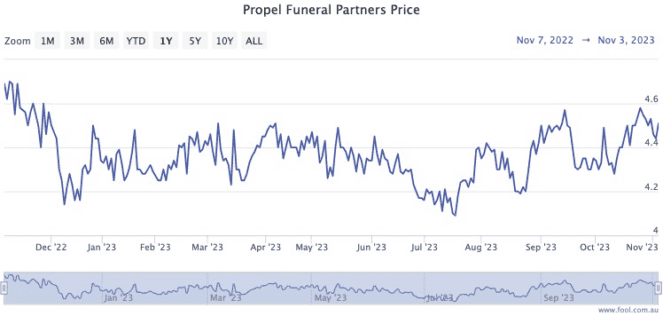

That's why Celeste analysts are bullish on Propel Funeral Partners Ltd (ASX: PFP) shares.

The company was also the target of some corporate interest in October.

"Propel Funeral Partners rose 3.7% over the month on the back of inbound interest from multiple parties regarding a change in control," the Celeste team stated in a memo to clients.

Management decided none of the suitors had presented a compelling enough offer, so didn't end up going further with any of them.

"Looking ahead, we continue to be attracted to PFP's defensive qualities," read the memo.

"We believe demographic tailwinds will support organic growth and management have ample capacity on the balance sheet to do further accretive acquisitions."

The Propel Funeral share price is up 6.9% so far this year, while paying out a respectable fully franked 3% dividend yield.

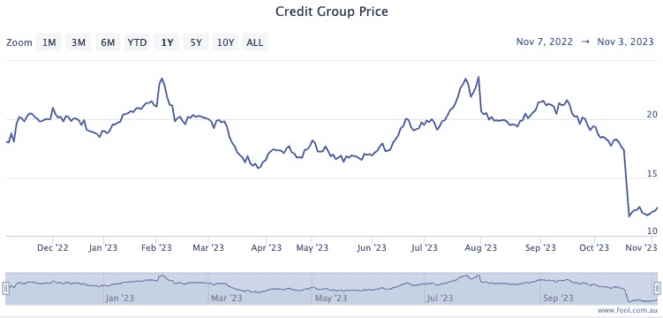

Massive selloff could mean these dividend shares are now a bargain

Whether it's through buying a home or otherwise, most Australians will have a debt sometime in their lives, if not for much of it.

So debt buyer Credit Corp Group Limited (ASX: CCP) sees as much business during tougher economic times as in better parts of the cycle.

Unfortunately for existing shareholders, Credit Corp shares plunged an ugly 37.7% last month.

Celeste analysts explained this was due to a one-off write-down.

"Credit Corp Group announced a $45 million impairment of the carrying value of its US Purchased Debt Ledger assets and downgraded their FY24 profit guidance by $10 million," read their memo.

"This was driven by a sustained deterioration in US collection conditions, compounded by Hurricane Idalia in late August."

Perhaps this is a buying opportunity because Celeste Funds is sticking by Credit Corp.

"Pleasingly, their Australian business remains robust with no signs of weakening conditions."

Thanks to a horror October, Credit Corp shares are now down more than 33%. But that has brought its fully franked dividend yield up to 5.7%.