There's been some significant takeover activity among ASX gold stocks this year.

The most prominent, of course, is the takeover of S&P/ASX 200 Index (ASX: XJO) gold share Newcrest Mining Ltd (ASX: NCM) by American gold mining giant Newmont Corporation (NYSE: NEM).

Newcrest shares had their last day of trading on the ASX last week on 26 October. Shares closed out the past 12 months up 35%.

With the gold price up 21% over the past year to US$1,984.18 per ounce, investor interest in the gold mining sector has been rekindled.

As has the potential of further takeovers.

We'll get to one particular ASX gold stock that Romano Sala Tenna, portfolio manager at Katana Asset Management, believes is ripe for a takeover in a tick.

But first…

What's happening with the gold price?

There are a lot of company-specific factors that will determine how well a gold stock performs. But the price of gold is a big one to watch.

On that front, the World Gold Council's Q3 Gold Demand Trends report revealed that quarterly global demand hit 1,147 tonnes, 8% higher than the five-year average.

Over the quarter, central banks bought 337 tonnes of the yellow metal. The 800 tonnes central banks have now bought year to date is a new record high in the World Gold Council's data series.

And the outlook for the gold price remains strong.

World Gold Council senior markets analyst Louise Street said, "Looking forward, with geopolitical tensions on the rise and an expectation for continued robust central bank buying, gold demand may surprise to the upside."

Which brings us back to…

Why this ASX gold stock could be targeted for takeover

The ASX gold stock in question is De Grey Mining Ltd (ASX: DEG).

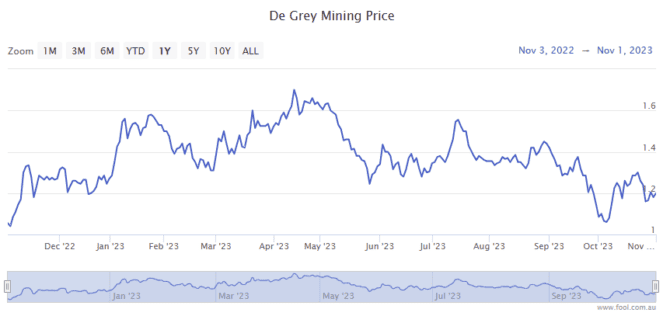

The De Grey Mining share price has lagged the broader gold miners' rally this year, as the company is still in the project development stage.

Management is targeting first gold from the company's Hemi gold mine – located in the Pilbara in Western Australia – in H2 2026.

De Grey recently released its Hemi Definitive Feasibility Study (DFS), reporting "outstanding physical and financial metrics". It's forecasting annual production of some 530,000 ounces per year at an all-in sustaining cost (AISC) of $1,229 per ounce.

On the balance sheet, the miner held $83 million in cash with no debt as at 30 September,

Sala Tenna believes the ASX gold stock is "considerably undervalued".

Citing the Hemi's status as "the third largest undeveloped gold project globally" alongside its ideal location in the Pilbara, Sala Tenna said he couldn't envision how "it doesn't get taken out at some point".

He added that the 530,000 tonnes per annum of gold production from the DFS only factored in reserves at Hemi, noting "substantial" potential upside on the horizon from ongoing drilling and exploration.

On the takeover front, Sala Tenna said, "For cashed-up global producers, this stock must surely be the standout on all metrics."

Katana Asset Management isn't alone in its bullish outlook for this ASX gold stock.

Goldman Sachs has a buy rating on De Grey Mining, with a price target of $1.40 per share.

That represents a 23% potential upside from the current $1.14 per share.